Analysis of Wednesday's Trades:

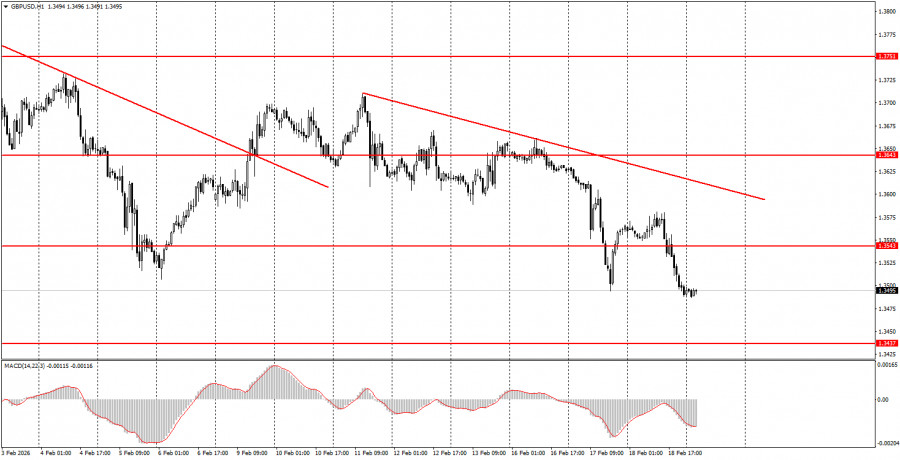

1H Chart of the GBP/USD Pair

The GBP/USD pair also traded lower on Wednesday, in line with the current downward trend. Even though we expect only declines from the dollar in 2026, it should be understood that the dollar cannot fall every day and every week. Recently, many factors have been stacking up against the British currency, leading to yet another downward correction. To understand the current trend, it is sufficient to look at the daily timeframe. An inflation report for January was published in the UK yesterday, and it is considered important. The consumer price index slowed to 3%, which opens the door for the Bank of England to consider a new easing of monetary policy. The day before, the unemployment report in the UK also significantly increased the likelihood of a key rate cut. Thus, the British pound has fallen quite deservedly this week. However, this does not mean that everything is perfectly fine in the US and that the dollar will not continue to decline.

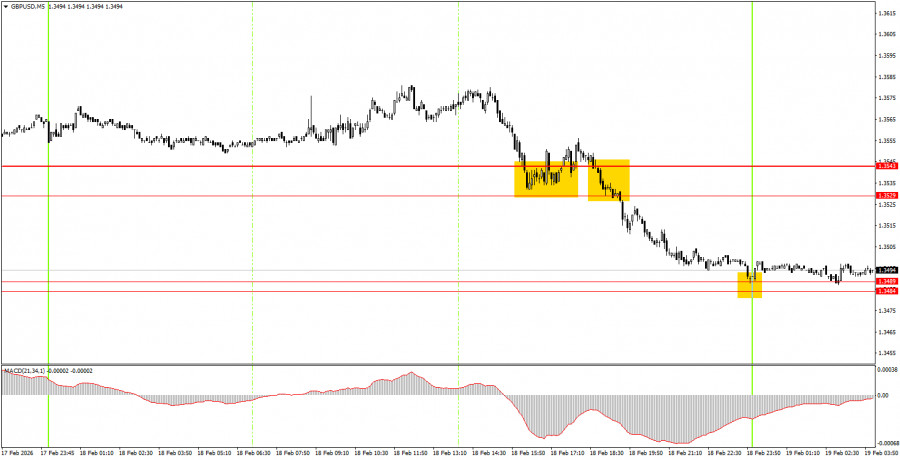

5M Chart of the GBP/USD Pair

On the 5-minute timeframe, two signals were formed on Wednesday, similar to the EUR/USD pair. Initially, the pound sterling bounced off the 1.3529-1.3543 area, but this buy signal proved false. Literally, half an hour later, the British currency settled below the area of 1.3529-1.3543 and reached the nearest support area of 1.3484-1.3489 by the end of the day. Thus, beginner traders might have incurred a loss on the first trade, but the second trade offset it and allowed them to close the day with a small profit.

How to Trade on Thursday:

On the hourly timeframe, the GBP/USD pair has broken the downward trend and has formed a new one. There are no global factors driving medium-term dollar growth, so in 2026, we expect the continuation of the global upward trend of 2025, which could push the pair to a low of 1.4000. In recent weeks, the situation has often not favored the British currency, which explains the somewhat unexpected fall of the British pound.

On Thursday, beginner traders may consider opening long positions if the pair bounces off the 1.3484-1.3489 area, targeting 1.3529-1.3543. A price settlement below the area of 1.3484-1.3489 would allow for new short positions with a target of 1.3437-1.3446.

On the 5-minute timeframe, levels to trade include: 1.3319-1.3331, 1.3365, 1.3403-1.3407, 1.3437-1.3446, 1.3484-1.3489, 1.3529-1.3543, 1.3643-1.3652, 1.3695, 1.3741-1.3751, 1.3814-1.3832, 1.3891-1.3912, 1.3975. On Thursday, no important events are scheduled in the UK. In the US, there will only be one minor report on unemployment claims. Volatility today may again drop to minimal values.

Main Rules of the Trading System:

- The strength of the signal is determined by the time it takes to form (rebound or breaking through the level). The shorter the time, the stronger the signal.

- If two or more trades were opened around a particular level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or no signals at all. In any case, it is best to stop trading at the first signs of a flat.

- Trades are opened during the time period between the start of the European session and until the middle of the American session, after which all trades should be manually closed.

- On the hourly timeframe, signals from the MACD indicator should ideally be traded only when there is good volatility and a trend confirmed by a trend line or channel.

- If two levels are too close to each other (ranging from 5 to 20 pips), they should be considered as a support or resistance area.

- After moving 20 pips in the correct direction, it is advisable to set the Stop Loss to break-even.

What's on the Charts:

- Support and resistance levels are targets for opening buy or sell trades. Take Profit levels can be placed around them.

- Red lines indicate channels or trend lines that reflect the current trend and indicate the preferred direction for trading now.

- The MACD indicator (14,22,3) – the histogram and signal line – serves as a supplementary indicator that can also be used as a source of signals.

- Important speeches and reports (always found in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, trading should be conducted with maximum caution, or it is advised to exit the market to avoid a sharp price reversal against the preceding movement.

- Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and practicing sound money management are the keys to long-term trading success.