Trade review for Wednesday:

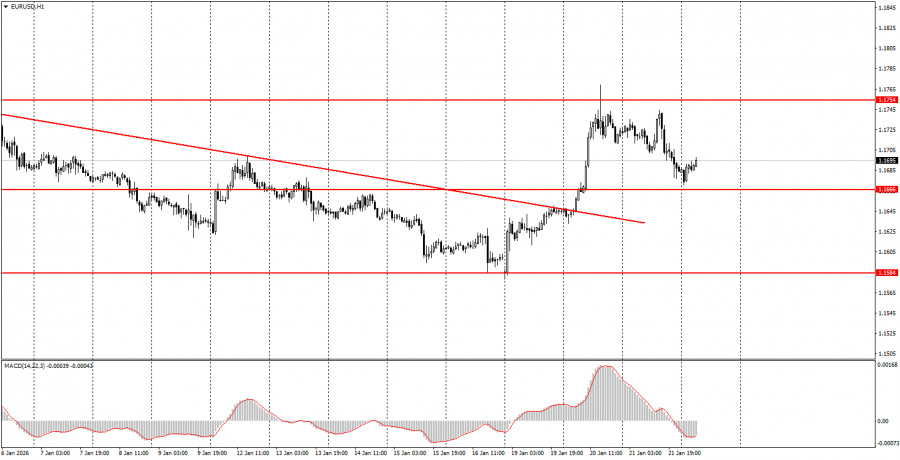

1H chart of the EUR/USD pair

The EUR/USD currency pair showed downward movement on Wednesday, but market sentiment changed several times during the day. There was no macroeconomic backdrop that day; the World Economic Forum was being held in Davos, where Donald Trump and many European leaders were to speak. Since the Greenland and tariff issues were still unresolved at that time, the market was openly nervous and hoped for a de-escalation of the conflict. As time showed, those expectations were not in vain. Donald Trump said that he had a good dialogue with NATO Secretary-General Mark Rutte, during which they agreed on an accord regarding Greenland. No details are available at the moment, but the US president announced that tariffs on European countries that do not support his plans for the Danish island are being lifted. Thus, Europe and the US avoided a new round of trade conflict, and market tensions immediately eased. The dollar gained a little, and the EUR/USD pair threatens to remain within the 1.1400–1.1830 sideways channel for several more months.

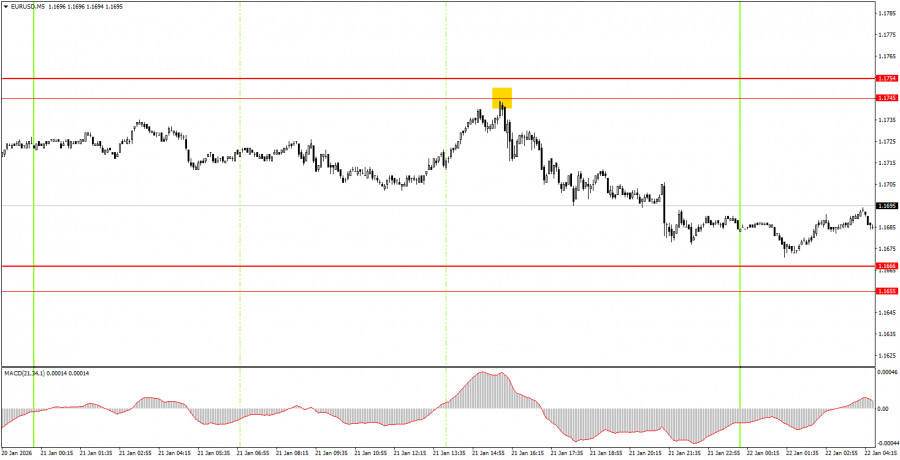

5M chart of the EUR/USD pair

On the 5-minute timeframe, only one trading signal was formed on Wednesday. At the start of the US session, the pair bounced off the 1.1745–1.1755 area with a 1-pip margin, and then continued to decline for the rest of the day. Thus, novice traders could open quite simple short positions that by the end of the day yielded profits of at least 40 pips.

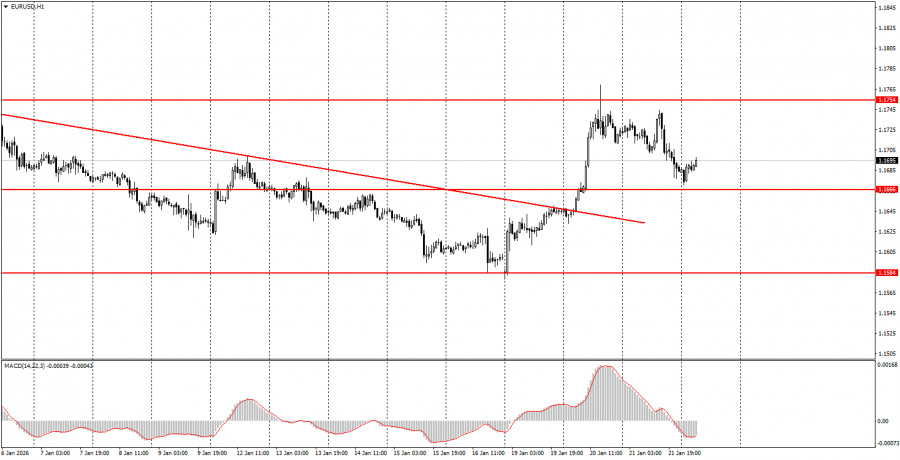

How to trade on Thursday:

On the hourly timeframe, the trend switched to upward. Thus, in the near term, the pair may return to the upper boundary of the 1.1400–1.1830 sideways channel to attempt to break it again and finally end the seven-month flat. The overall fundamental and macroeconomic backdrop remains very weak for the US dollar, but the daily-timeframe flat plays a priority role, and traders are paying almost no attention to the macroeconomic picture.

On Thursday, novice traders can open new long positions in case of a bounce from the 1.1655–1.1666 area with a target of 1.1745–1.1755. A close below the 1.1655–1.1666 area would allow opening new shorts targeting 1.1584–1.1591.

On the 5-minute timeframe, consider the levels 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527–1.1531, 1.1550, 1.1584–1.1591, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. Today, no major events are scheduled in the Eurozone, while the US will publish the third estimate of Q3 GDP and several secondary reports, including the producer price index. The conflict with the EU is resolved, so volatility may return to normal levels.

Main rules of the trading system:

- Signal strength is judged by the time required to form the signal (rebound or breakout). The less time required, the stronger the signal.

- If two or more trades were opened on false signals near a level, then all subsequent signals from that level should be ignored.

- In a flat, any pair can generate many false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades are opened during the period between the start of the European session and the middle of the American session; after that, all trades must be closed manually.

- On the hourly timeframe, MACD-based signals should ideally be traded only when volatility is high, and a trend is confirmed by a trendline or trend channel.

- If two levels are located too close to each other (5–20 pips), they should be considered as a support or resistance area.

- After the price moves 15 pips in the correct direction, place a stop loss at breakeven.

What is shown on the charts:

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.