The EUR/USD currency pair traded with minimal volatility and no clear direction throughout Friday. The upward trend remains intact without any doubt. However, a significant strengthening of the U.S. dollar is likely on Monday. Why? Let's break it down in this article.

Last week's central theme was the confrontation between Israel and Iran, with the direct involvement of the U.S.—not the Federal Reserve or Bank of England meetings. In our opinion, both central bank meetings ultimately benefited the U.S. dollar. The Fed revised its projections and now expects fewer rate cuts over the next three years, again adopting a more hawkish tone than traders had anticipated. However, the Fed's monetary policy has ceased to matter much for the dollar. For nearly a year now, the Fed has regularly surprised with hawkish stances, yet the dollar has continued to fall over the past five months—mainly due to Donald Trump's presidency.

Although we won't detail all of Trump's decisions, the turmoil he has caused is putting significant pressure on the dollar. So, why might the dollar strengthen on Monday? This is because, on Saturday, the U.S. launched a devastating strike on Iran's key nuclear facilities. Throughout the previous week, Trump had repeatedly warned of a potential strike if Tehran refused to sign a "peace agreement," which, in his view, entails complete nuclear disarmament, a ban on uranium enrichment, and abandonment of all future nuclear programs. Tehran rejected the ultimatum. On Thursday, Trump seemed to back off, saying he'd need two more weeks to make a decision.

Surprisingly, Trump did not wait. On Saturday, he unexpectedly ordered a missile strike. According to him, several major nuclear facilities were destroyed. He promised even more extensive airstrikes if Tehran refused to sign the deal. Trump added that Iran still has many nuclear sites, and the latest strikes only hit the primary ones. He is offering Iran the chance to avoid further destruction by agreeing to the deal. This represents a major escalation in the Middle East, and the dollar may benefit. In recent weeks, the greenback has appreciated several times amid rising tensions over Iran.

Iran's Supreme Leader, Ali Khamenei, warned Trump that any strike on Iran would have serious consequences for the U.S. This week, tensions could rise even further. Iran may retaliate not only against Israel but also against U.S. military bases in the region. We don't expect the dollar to surge, but a moderate gain is possible.

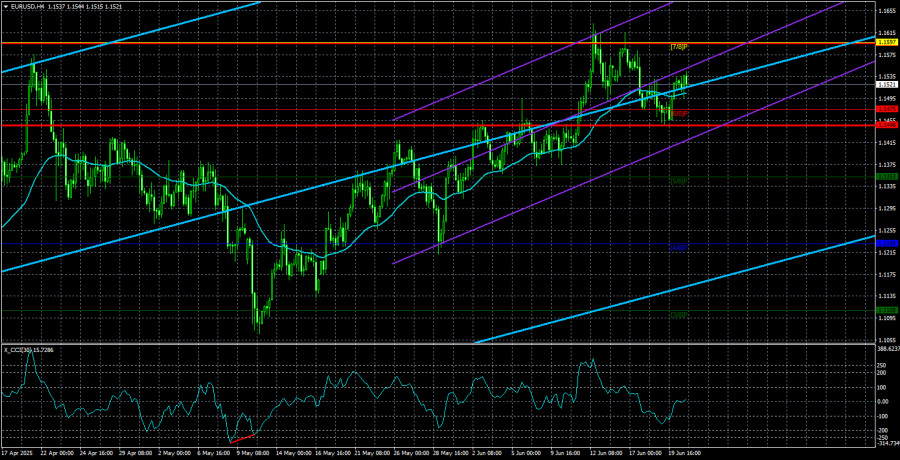

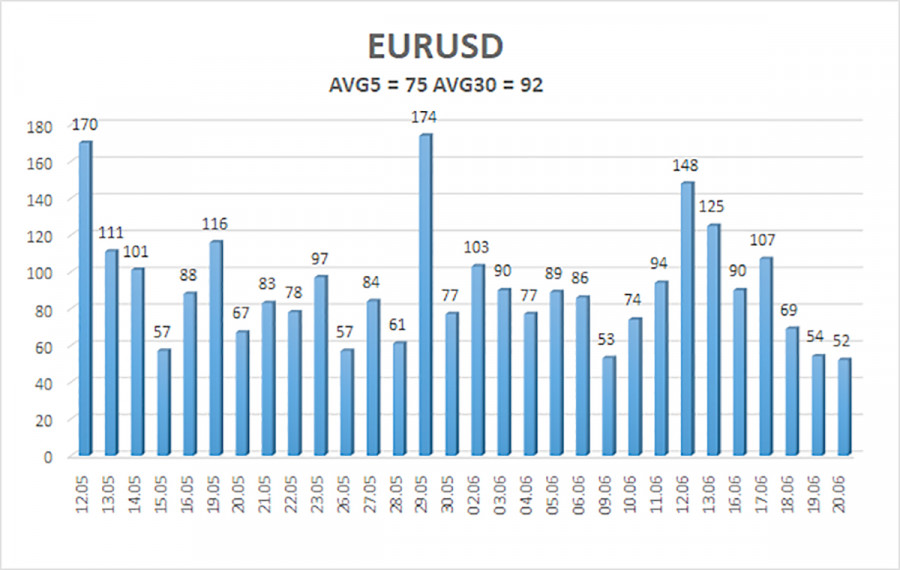

The average volatility of the EUR/USD pair over the last five trading days as of June 23 is 75 pips, which is considered "moderate." On Monday, we expect the pair to move between 1.1446 and 1.1596. The long-term regression channel points upward, indicating the continuation of the uptrend. The CCI indicator entered overbought territory, triggering only a slight downward correction—but the correction may continue.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues its upward trend. Trump's domestic and foreign policies still exert significant pressure on the U.S. dollar. Moreover, the market interprets many data points against the dollar or ignores them outright. There appears to be a complete reluctance to buy the dollar under any circumstances. Below the moving average, short positions remain relevant, with targets at 1.1446 and 1.1353. However, a sharp drop in the pair is unlikely in the current environment. Above the moving average, long positions can be considered with targets at 1.1597 and 1.1719, which aligns with the ongoing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.