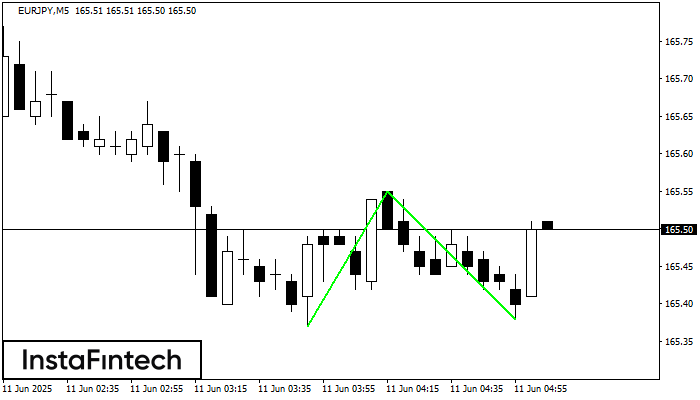

was formed on 11.06 at 04:05:14 (UTC+0)

signal strength 1 of 5

signal strength 1 of 5

The Double Bottom pattern has been formed on EURJPY M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 165.55 is broken. The further movements will rely on the width of the current pattern 18 points.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength