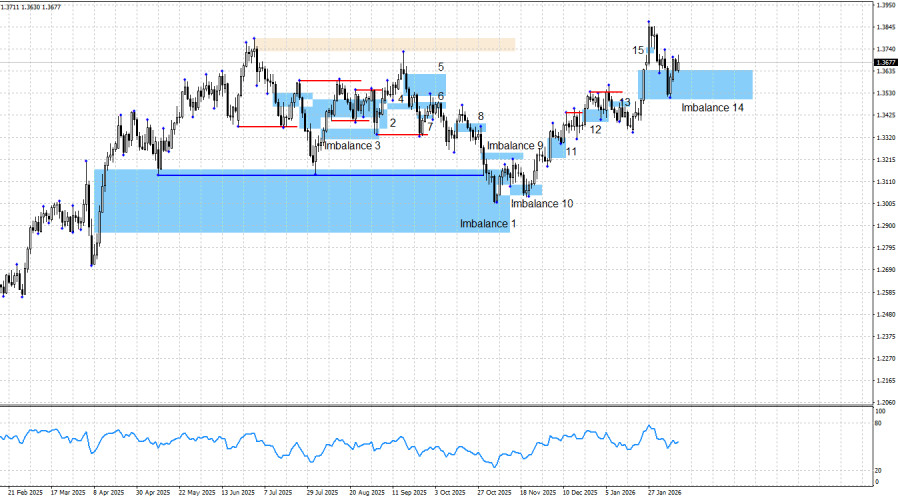

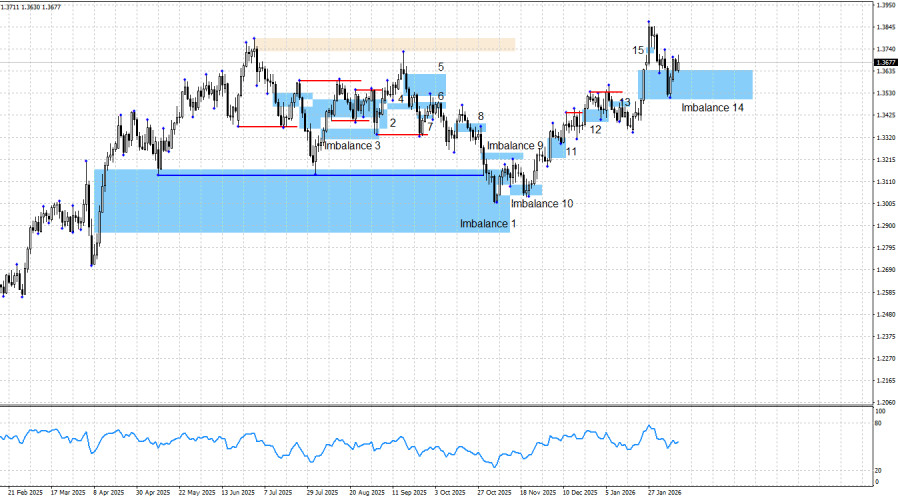

The GBP/USD pair has fully filled the latest bullish imbalance, receiving a reaction from its lower boundary. Thus, a bullish signal has also formed on the pound, as I expected. Most importantly, buy signals formed almost simultaneously for both the pound and the euro. This significantly increases the likelihood of further growth in both currency pairs.

However, bullish traders were hit from an unexpected direction. Let me remind you that U.S. labor market data began to be released last week. The first were ADP and JOLTS reports. Both showed figures that do not align well with the idea of a recovery. Traders quite logically began to expect weak Nonfarm Payrolls and unemployment data. But as often happens, you expect one thing and get something entirely different. The U.S. labor market data turned out to be impressive, which has so far triggered moderate but justified bearish attacks. Therefore, the main task in the near future will be to understand how much strength these reports have given to the bears and to the dollar. Just as I previously advised against rushing to conclusions ahead of the U.S. reports, I now advise against rushing to conclusions after the figures have been released. Despite the strength of the reports, the bullish trend remains intact for both the euro and the pound. Moreover, the dollar has been declining for the past 13 months not only because of labor market weakness. I believe the bears' attacks may prove weak and short-lived.

The bullish trend in the pound remains in place, which is confirmed by the technical picture. Since November 5, traders have had at least three opportunities to open long positions. During this time, the pound has risen by 640 points, measuring from the low of the move to the current price level. Bullish signals continue to form regularly, while bearish patterns have not appeared for a long time. In my view, this is not the moment to overcomplicate things. There are currently no signs of a bearish advance.

Wednesday's news background was fairly strong, but as I have already said, there is no need to rush to conclusions. The labor market and unemployment reports showed that the Federal Reserve has no urgent need to implement further monetary easing. However, I would like to remind you that labor market data alone does not determine Fed policy. The inflation report is still ahead, and it could significantly increase the chances of a Fed rate cut in the coming months.

In the United States, the overall news background remains such that, in the long term, little can be expected other than further dollar weakness. The situation in the U.S. remains quite complex. U.S. labor market statistics continue to disappoint more often than they impress. Three of the last four FOMC meetings ended with dovish decisions. Trump's military actions, threats toward Denmark, Mexico, Cuba, Colombia, Iran, EU countries, Canada, and South Korea, criminal proceedings against Jerome Powell, a new government shutdown, and the scandal involving U.S. elites in the Epstein case all add to the current picture of political and structural crisis in the country. In my view, the bulls have everything they need to continue their advance throughout 2026.

A bearish trend would require a strong and consistent positive news background for the dollar, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as it would keep the trade balance in deficit. Therefore, I still do not believe in a bearish trend for the pound. Too many risk factors continue to weigh heavily on the dollar. If new bearish patterns appear, a potential decline in the pound could be considered, but at the moment there are none.

News Calendar for the U.S. and the U.K.:

- United Kingdom – GDP change for Q4 (07:00 UTC).

- United Kingdom – Industrial production change (07:00 UTC).

- United States – Initial Jobless Claims (13:30 UTC).

- United States – Existing Home Sales (13:30 UTC).

On February 12, the economic calendar contains four entries, none of which are particularly significant. The impact of the news background on market sentiment on Thursday may be present but limited.

GBP/USD Forecast and Trading Advice:

For the pound, the outlook remains bullish; a new buy signal has formed and has not yet been invalidated. The bulls have launched a new advance, which threatens to become prolonged and substantial. Since the bullish trend is not in doubt, traders can continue trading to the upside based on clear patterns and signals. Imbalance 14, as expected, provided such an opportunity. As a potential growth target, I considered the level of 1.3725, which has already been reached, but the pound may rise much higher in 2026. There are no strict limits. The nearest significant target appears to be 1.4246 — the June 2021 peak.