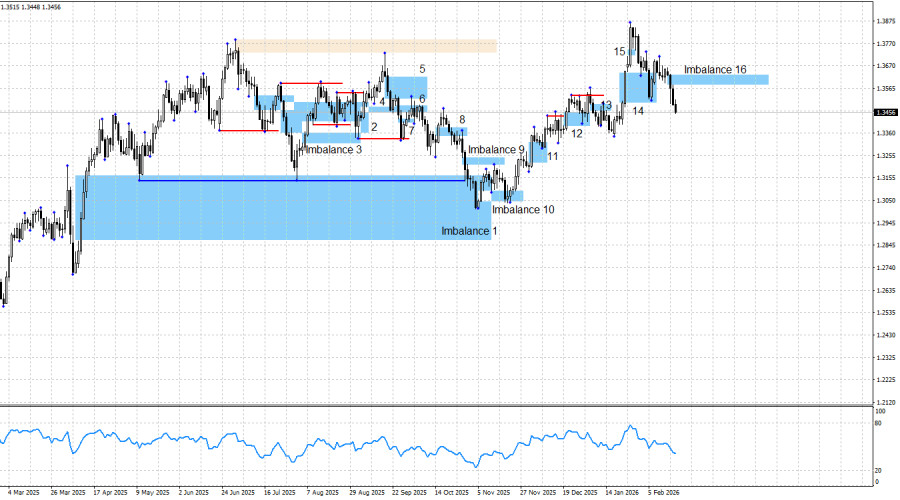

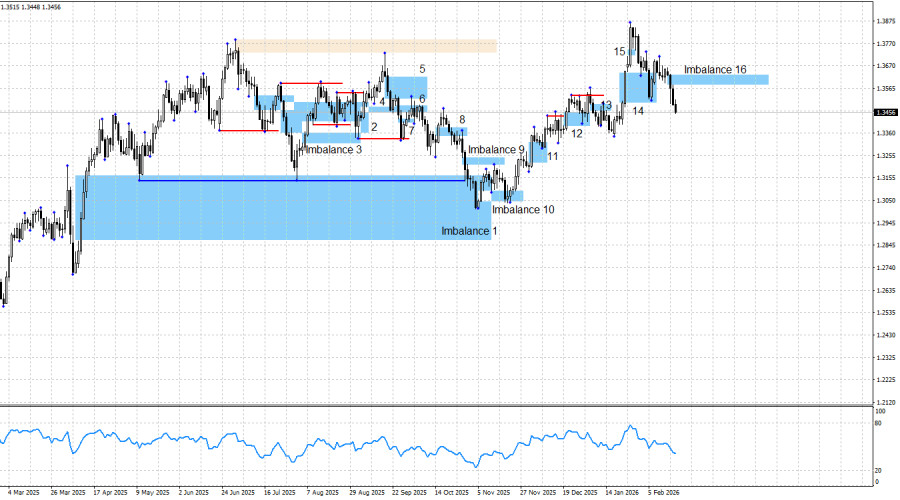

The GBP/USD pair has filled the last "bullish" imbalance 100%, reacted to its lower boundary, climbed to the upper boundary of the pattern — and that's where the bulls ran out of strength. A second reaction to Imbalance 14 never occurred, and the pound's quotes have been literally plunging for the third consecutive day. I can explain the pound's decline on Tuesday and Wednesday, as the economic data from the UK were not particularly positive. But today the bears continue to attack, even though the news background has been virtually absent.

In my view, the news backdrop remains more favorable for bulls than for bears. However, the market clearly disagrees with this assessment. There are no "bullish" patterns serving as downward targets for the British pound. Therefore, the pound can fall anywhere. I believe that in the near future it makes sense to monitor potential liquidity grabs at obvious "bearish" swings. The nearest such level is 1.3341. This week, for the first time in a long while, a "bearish" imbalance was formed, labeled No. 16. However, in my opinion, the question of the appropriateness of selling the pair within a "bullish" trend remains open. I believe that if a reaction to Imbalance 16 occurs, selling opportunities could be considered — but with extreme caution.

The "bullish" trend in the pound remains intact, which is confirmed by the chart structure. Therefore, as long as the "bullish" trend holds (above 1.3012), I would focus more on bullish signals. The pound's decline could be quite strong, but it may also end at any moment. I do not see sufficient reasons for the pound to fall 200 points over three days. In any case, we now need either new "bullish" patterns or the completion of the only existing "bearish" one.

Thursday's news background was extremely weak, yet it once again helped the bears. I do not believe that today's sell-off should be directly linked to the jobless claims report and the Philadelphia business activity index, although both reports exceeded market expectations. The pound's decline began in the morning and has taken on a collapse-like character overall — something that two secondary U.S. reports could hardly have triggered.

In the United States, the overall news background remains such that, in the long term, nothing but a decline in the dollar can be expected. The situation in the U.S. remains rather complicated. U.S. labor market statistics continue to disappoint more often than they please. Three of the last four FOMC meetings ended with "dovish" decisions. Trump's military aggression, threats toward Denmark, Mexico, Cuba, Colombia, Iran, EU countries, Canada, and South Korea, the initiation of criminal proceedings against Jerome Powell, another "shutdown," and the scandal involving the U.S. elite in the Epstein case all complement the current picture of political and structural crisis in the country. In my opinion, bulls have every reason to continue their advance throughout 2026.

A "bearish" trend would require a strong and stable positive news background for the dollar — something that is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need an expensive dollar, as in that case the trade balance would remain in deficit. Therefore, I still do not believe in a "bearish" trend for the pound. Too many risk factors continue to weigh heavily on the dollar. If new "bearish" patterns appear, a potential decline in the pound could be considered, but at the moment there are none.

News Calendar for the U.S. and the UK:

United Kingdom

- Retail Sales Change (07:00 UTC)

- Manufacturing PMI (09:30 UTC)

- Services PMI (09:30 UTC)

United States

- Core Personal Consumption Expenditures (13:30 UTC)

- Q4 GDP Change (13:30 UTC)

- Personal Income/Spending (13:30 UTC)

- Manufacturing PMI (14:45 UTC)

- Services PMI (14:45 UTC)

On February 20, the economic calendar will be quite full. The impact of the news background on market sentiment on Friday may persist throughout the entire day.

GBP/USD Forecast and Trader Advice:

The overall picture for the pound remains "bullish," although the current short-term setup has turned "bearish." There are no active "bullish" patterns at the moment. There is only a single "bearish" imbalance, to which the price must first return and show a reaction before traders can consider potential short positions. Since the trend remains "bullish," I would place greater emphasis on bullish patterns.