Trade Analysis and Trading Tips for the European Currency

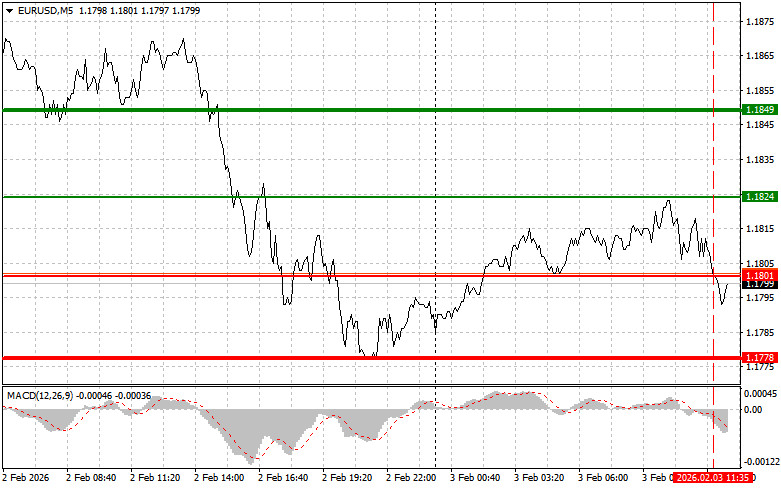

The test of the 1.1801 price level occurred at a moment when the MACD indicator had moved significantly downward from the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro.

The released data on French CPI pointed to a sharp decline in price pressure; however, this had no effect on the euro. At the same time, the dynamics of rising unemployment benefit claims in Spain were disappointing. A sharp increase in the number of unemployed will surely become an alarming signal for the authorities. The lack of market reaction to the data indicates that market participants have taken a wait-and-see position ahead of more significant events.

In the second half of the day, the JOLTS report from the Bureau of Labor Statistics will be published, focusing on job openings and labor market dynamics. This report should clarify the current state of the U.S. labor market. Market participants always analyze this report, as it can provide insight into how strong employers' demand for workers is and whether wage growth may increase, which in turn affects inflation forecasts. A figure exceeding the forecast number of job openings would indicate that employers are actively hiring, which could encourage the Federal Reserve to maintain a wait-and-see stance with high interest rates.

At the same time, the RCM/TIPP Economic Optimism Index will provide important information regarding sentiment among both ordinary consumers and business representatives about the current economic situation and its outlook. This indicator reflects confidence in economic growth opportunities, investment, and consumer spending, while also serving as an important leading indicator of economic development trends.

In the case of strong data, pressure on the euro against the U.S. dollar will increase significantly.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

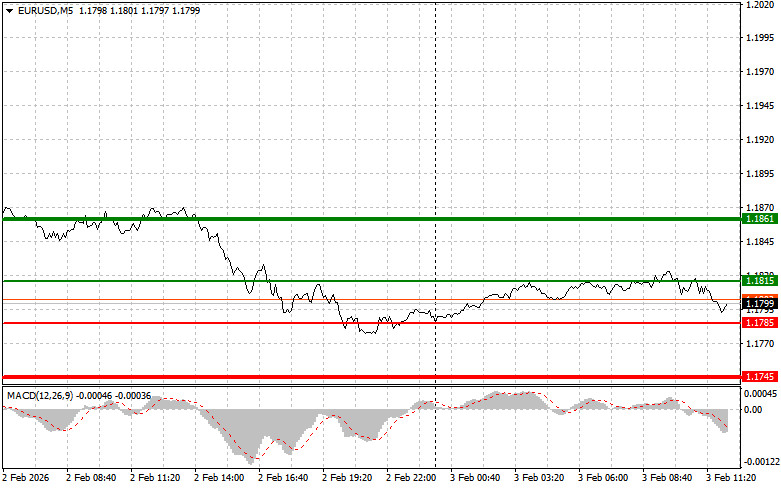

Buy Signal

Scenario No. 1: Today, buying the euro is possible when the price reaches the 1.1815 level (green line on the chart), with a growth target at 1.1861. At the 1.1861 level, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35-point move from the entry point. Strong euro growth can only be expected after weak economic data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1785 price level at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1815 and 1.1861 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1785 level (red line on the chart). The target will be the 1.1745 level, where I intend to exit the market and immediately buy in the opposite direction (aiming for a 20–25-point move in the opposite direction from that level). Pressure on the pair will return in the case of strong economic data.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1815 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1785 and 1.1745 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price where Take Profit orders can be placed or profits can be manually locked in, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price where Take Profit orders can be placed or profits can be manually locked in, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to pay attention to overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.