The GBP/USD currency pair also remained within a narrow range on Monday, slowly correcting after its surge last week. However, we have little doubt that the British currency will continue to grow. At this point, it doesn't even matter what news is coming from Europe or the UK. Several global factors will determine movements across all instruments in the foreign exchange market.

Firstly, after seven months, the flat for the euro has ended. Thus, the European currency, which has remained in an upward trend (as has the British pound), now has a legitimate chance of considerable growth in 2026. If the euro increases, the pound will rise along with it, regardless.

Secondly, the market is currently ignoring almost any positive news from America. Traders simply do not believe in the remarkable growth of the American economy, which is based on a policy of protectionism, autocracy, and blatant extortion worldwide. Yes, the American economy is growing at almost record rates, despite the trade war and the White House's external policies. However, this growth is artificial, not real. In other words, Americans are unlikely to feel improvements when they open their wallets in front of store shelves.

Thirdly, Donald Trump does not intend to take a break or stop at what he has achieved. Last week showed that the primary issue limiting the dollar's decline was the flat for the euro in the range of 1.1400-1.1830. Now that the problem has been resolved, last week the US dollar was sold off amid escalating geopolitical conflict over Greenland and the escalation of the trade conflict with the European Union, as well as its de-escalation. Now, in any ambiguous situation, the market prefers to sell the dollar out of caution. The more Trump encroaches on other countries, the more the dollar will decline.

This week, the Fed will hold its first meeting in 2026, and it is crucial for traders not to forget about this significant event. Earlier, the meetings of the world's largest central bank were anticipated a week in advance, with forecasts for outcomes and discussions about what rhetoric Jerome Powell would maintain and what changes he would hint at for the future. Now, the Fed meeting outcomes hold virtually no significance. What will change for the American currency if the Fed shows readiness to resume monetary easing soon? The dollar will fall even faster and more freely. As for supporting the US currency, that conversation is no longer relevant because the Fed is clearly not going to raise the key rate.

Thus, the essence of the question is only how quickly the dollar will fall in 2026. Of course, pauses, corrections, and pullbacks are possible. However, considering Trump's general policies, we have no doubt that 2026 will bring nothing positive for the American currency.

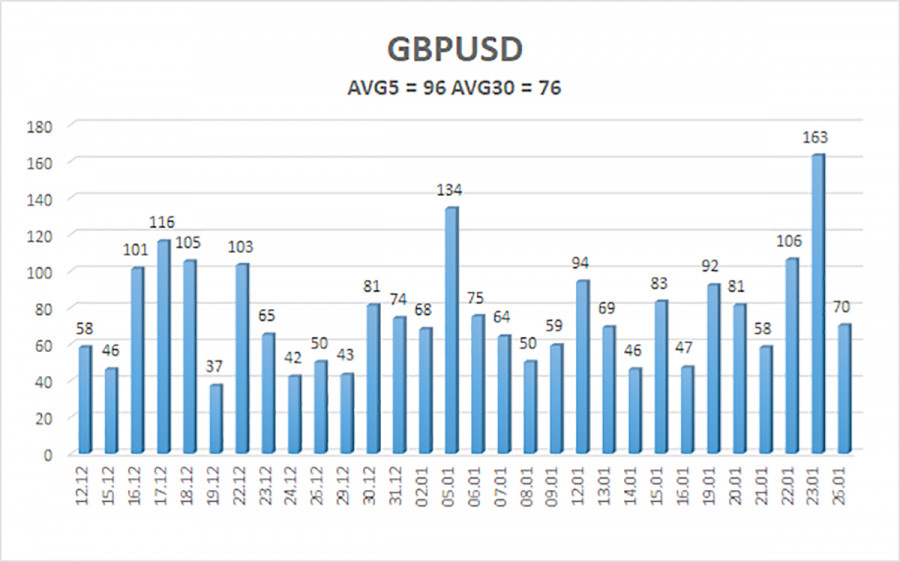

The average volatility of the GBP/USD pair over the last five trading days amounts to 96 pips, which is considered "average." On Tuesday, January 27, we expect movement within the range between 1.3605 and 1.3797. The upper linear regression channel points upward, indicating a trend recovery. The CCI indicator has entered the overbought territory six times over the past months and has formed numerous "bullish" divergences, constantly warning traders about an impending resumption of the upward trend.

Nearest Support Levels:

S1 – 1.3672

S2 – 1.3611

S3 – 1.3550

Nearest Resistance Levels:

R1 – 1.3733

R2 – 1.3794

Trading Recommendations:

The GBP/USD currency pair is on track to resume the 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the US economy, so we do not expect the US currency to grow in 2026. Even its status as a "reserve currency" no longer matters to traders. Therefore, long positions with targets at 1.3733 and 1.3794 remain relevant for the near future as long as the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target at 1.3489 on technical (correction) grounds. From time to time, the US currency shows corrections (in the global sense), but for trend growth, it requires global positive factors.

Explanations for the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in one way, the trend is currently strong;

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are target levels for movements and corrections;

- Volatility levels (red lines) indicate the probable price channel in which the pair will operate for the next day, based on current volatility indicators;

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.