The EUR/USD pair reversed in favor of the European currency this week and began an upward move which, over the first two days of the week, covered most of the decline of the previous three weeks. Under current conditions, it can be said that the market is fleeing from a troubled dollar, but this situation is not new. Ever since Donald Trump became U.S. president, the market has largely been shedding the American currency. Trump's new trade tariffs are not just new tariffs—they effectively constitute a violation of the trade agreement concluded in 2025.

Donald Trump himself, however, does not believe that the 2025 trade agreement will be canceled. An international forum will take place in Davos today, where Trump will meet with European leaders. The discussion will focus precisely on the "Greenland issue," and later today or tomorrow we will learn what to expect next. France and Germany support the introduction of tough retaliatory sanctions in response to attempts at blackmail and pressure on EU countries. However, far from all EU members support the option of open confrontation with the United States. Put simply, it is easier for Poland to give up Danish Greenland than to face new tariffs and worsen its own economic position. As a result, it may turn out that EU countries decide to abandon Greenland, which belongs solely to Denmark.

At present, traders have two possible trading options. Since the bullish trend remains intact, one can wait for the formation of new bullish patterns. The second option is to trade sell positions based on bearish patterns, which are currently absent but may appear in the future. However, any decline of the pair under the current circumstances may only be a corrective pullback, which should be kept in mind when opening short positions.

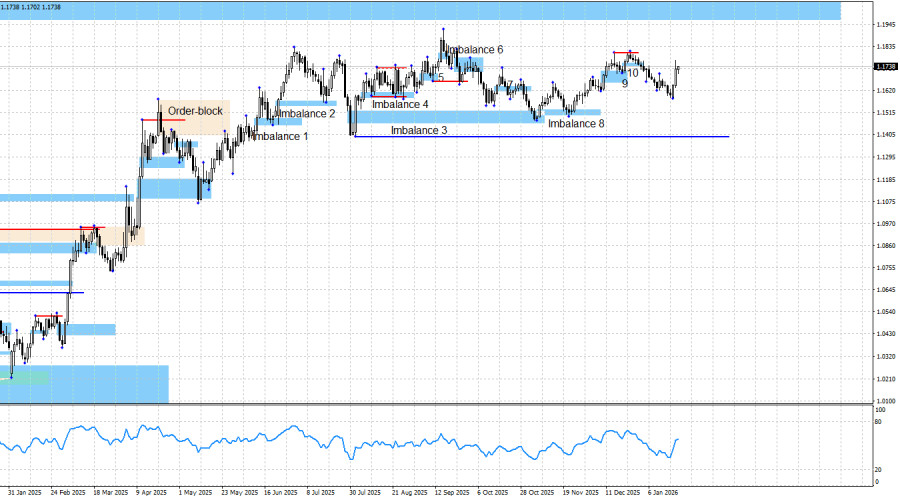

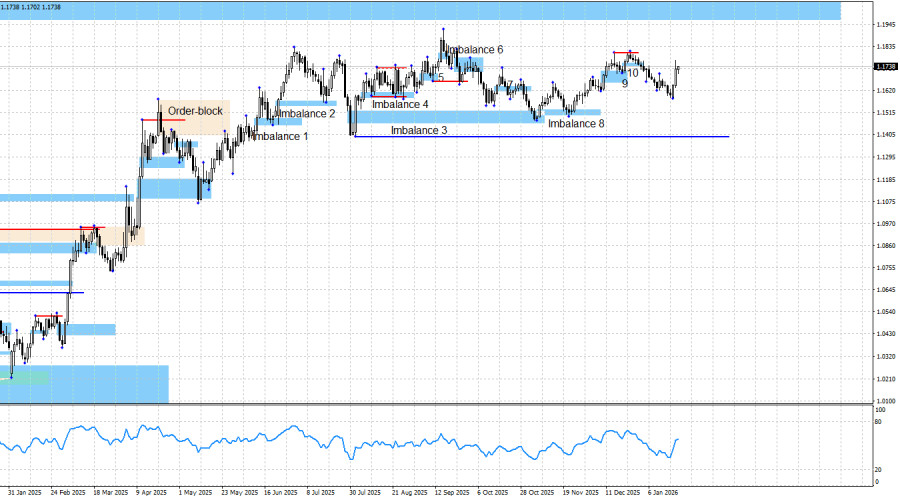

The chart picture continues to signal bullish dominance in the longer term. The bullish trend remains in place. A new bullish signal may already form on Thursday, as the European currency showed rapid growth on Monday and Tuesday. As a result, a bullish imbalance will be formed, from which traders may later open long positions.

This week's news background can be divided into two parts: economic and political. The economic component held no value for traders. Even the important EU inflation report was ignored. The euro is rising because the geopolitical background—particularly Donald Trump's new trade tariffs—matters more. Trump introduced new 10% tariffs against a whole list of EU countries and the United Kingdom in response to their refusal to recognize U.S. claims to Greenland. The EU is preparing a package of retaliatory tariffs and countermeasures but will attempt to reach an agreement with the confrontational U.S. president before February 1.

The bulls have had plenty of reasons for a new offensive for the past 4–5 months, and their number only continues to grow. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the U.S.–China confrontation (where only a temporary truce has been reached), protests by the American public against Trump under the "No Kings" banner, weakness in the labor market, bleak prospects for the U.S. economy (recession), and the government shutdown (which lasted a month and a half but was clearly not priced in by traders). Now, in addition, there is U.S. military aggression toward certain states, criminal prosecution of Powell, and new trade tariffs against European countries. Thus, further growth of the pair, in my view, is entirely natural.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I do not even try to do so. The blue line shows the price level below which the bullish trend could be considered over. Bears would need to push the price down by about 340 pips to reach it, and I consider this task impossible under the current news background and circumstances. The nearest upside target for the European currency remains the bearish imbalance at 1.1976–1.2092 on the weekly chart, which was formed back in June 2021.

News Calendar for the U.S. and the European Union:

- United States – GDP growth rate (Q3) (13:30 UTC).

- United States – Initial jobless claims (13:30 UTC).

- United States – Core Personal Consumption Expenditures Price Index (15:00 UTC).

- United States – Personal income and spending (15:00 UTC).

On January 22, the economic calendar contains four events, one of which is of heightened interest. The influence of the news background on market sentiment on Thursday may appear in the second half of the day. Unexpected outcomes from the Davos meeting may also trigger a market reaction.

EUR/USD Forecast and Trading Advice:

In my view, the pair remains in the process of forming a bullish trend. Despite the fact that the news background continues to favor the bulls, bears have been launching regular attacks over recent months. Nevertheless, I see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In all cases, we saw some growth, but the bullish trend was not extended. New long positions are quite acceptable if a new bullish signal is formed. However, at the moment, there are no workable bearish or bullish patterns.