Trade Review and Trading Tips for the Japanese Yen

None of the levels I identified were tested during the first half of the day.

In the second half of the day, extremely important economic releases are expected: the U.S. Consumer Price Index (CPI) and its core version, which excludes food and energy prices. In addition, weekly data on initial jobless claims in the United States will be published. The market is on hold ahead of the news. Investors and market participants around the world are closely watching the upcoming reports, as these data may have a significant impact on the future monetary policy strategy of the Federal Reserve. Inflation—especially the core measure—remains a key benchmark for the Fed's interest rate decisions. If CPI data come in above forecasts, this may intensify concerns about persistent inflationary pressure, which in turn could lead to a stronger dollar against the yen. At the same time, weaker-than-expected data may reduce inflation concerns and allow the Fed to take a more dovish stance. The report on initial jobless claims is no less important. An increase in this indicator may signal weakening in the labor market, which could also affect Fed decisions. Historically, a strong labor market has given the Fed greater confidence to raise interest rates to fight inflation; however, existing unemployment issues in the U.S. could be further exacerbated by a sharp rise in price pressures.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

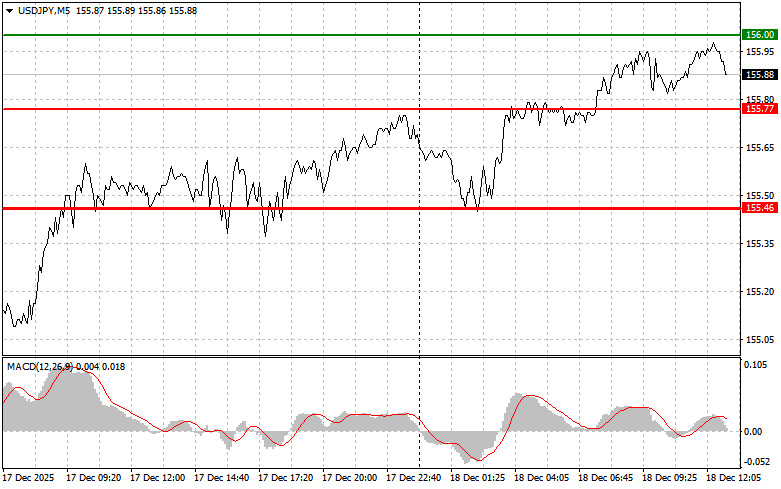

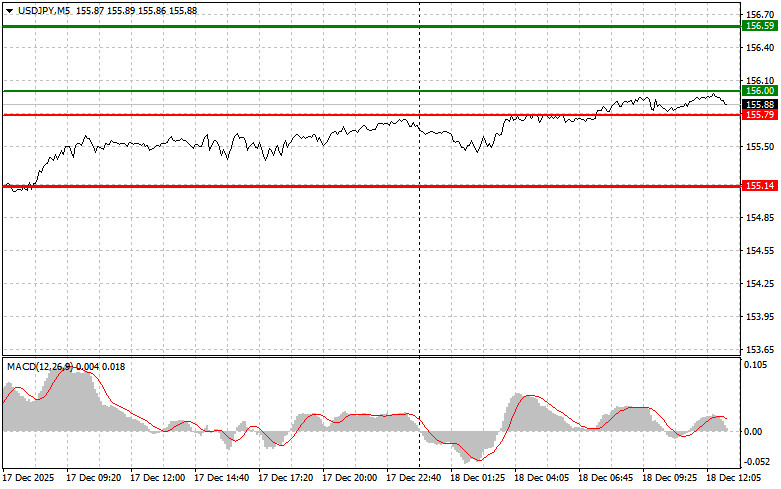

Scenario No. 1: Today, I plan to buy USD/JPY upon reaching an entry point around 156.00 (green line on the chart), with a target of growth toward the 156.59 level (the thicker green line on the chart). Around 156.59, I will exit long positions and open short positions in the opposite direction (aiming for a 30–35 point move in the opposite direction from that level). A rise in the pair can be expected only after an increase in U.S. inflation.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 155.79 price level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal of the market upward. Growth toward the opposite levels of 156.00 and 156.59 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after an update (break) of the 155.79 level (red line on the chart), which should lead to a rapid decline in the pair. The key target for sellers will be the 155.14 level, where I will exit short positions and also open buy positions in the opposite direction (aiming for a 20–25 point move in the opposite direction from that level). Pressure on the pair will return only in the case of a sharp drop in U.S. inflation.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 156.00 price level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal of the market downward. A decline toward the opposite levels of 155.79 and 155.14 can be expected.

What You See on the Chart

- Thin green line – the entry price at which the trading instrument can be bought.

- Thick green line – the estimated price where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely.

- Thin red line – the entry price at which the trading instrument can be sold.

- Thick red line – the estimated price where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when making market entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.