Global markets at a crossroads: investor nerves fray, dollar loses ground

Global equity markets retreated on Tuesday, dragging the MSCI All-Country World Index lower, as prolonged uncertainty over US trade negotiations and anticipation of signals from the Federal Reserve weighed heavily on investor sentiment. The US dollar slipped against major currencies, reflecting waning confidence in American economic policy.

Treasuries spark bidding frenzy

In a surprise move, demand for 10-year US Treasury bonds surged during an auction, with yields falling to session lows. The strong appetite highlights a rush into safe-haven assets as market participants seek shelter amid global uncertainty.

Euro climbs on political upheaval in Germany

In currency markets, the euro advanced following an unexpected shift in German politics. Conservative lawmaker Friedrich Merz, after initially falling short, secured the chancellorship in a second-round vote in the Bundestag. The surprising result bolstered the euro, which strengthened against the dollar.

US and China: no talks on the horizon

Trade tensions, particularly between Washington and Beijing, remain a central concern for global markets. China, the world's second-largest economy, had previously indicated a willingness to evaluate a US proposal to resume trade talks. However, US Treasury Secretary Scott Bessent signaled that despite active negotiations with 17 countries, no formal contact has been established with China. He also hinted that deals with a number of nations could be announced this week, though he declined to specify which ones.

London and New Delhi find common ground

While Washington stalls on trade diplomacy, others are moving forward. On Tuesday, the United Kingdom and India signed a free trade agreement, a breakthrough both sides had been pursuing amid instability fueled by US tariff policies. The new pact, covering goods such as whisky, automobiles, and agricultural products, marks a significant step toward deeper economic ties between the two countries.

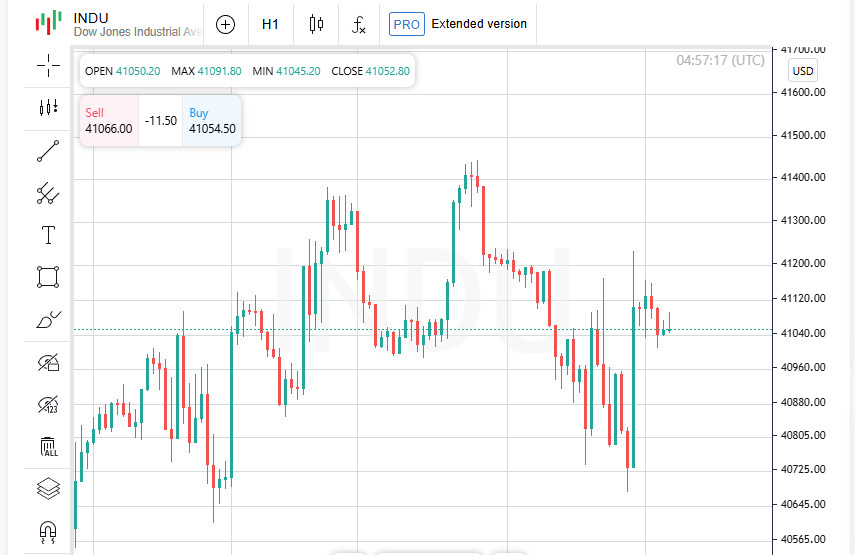

Wall Street under pressure

US equities ended Tuesday's session deep in the red. Investor hesitancy ahead of remarks from the Federal Reserve and weak trade cues triggered a broad market correction:

- Dow Jones Industrial Average: down 389.83 points (–0.95%) to close at 40,829.00

- S&P 500: down 43.47 points (–0.77%) to end at 5,606.91

- Nasdaq Composite: down 154.58 points (–0.87%) to settle at 17,689.66

Global benchmarks also succumbed to pressure:

- MSCI World Index: down 0.40% to 842.83

- STOXX 600 (Europe): down 0.18%

- DAX (Germany): finished 0.4% lower, after plunging nearly 2% intraday.

All eyes on the Fed: markets hold their breath

Investors on both sides of the Atlantic are nervously focused on the upcoming Federal Reserve meeting, with results expected on Wednesday. While no change in the benchmark interest rate is anticipated, market participants will scrutinize the central bank's language for any signals of a potential shift toward monetary easing. Even a subtle hint at rate cuts could trigger a rally, while a lack of dovish tone may add to market volatility.

Dollar slips against major rivals

As expectations for a Fed policy shift mount, the US dollar has come under renewed pressure. Currency markets have responded swiftly, with sharp moves across major pairs:

Key currency movements:

- US Dollar Index (DXY) fell by 0.62% to 99.19

- EUR gained 0.57%, reaching $1.1378

- JPY strengthened by 0.91% against USD to settle at £142.39

- GBP rose by 0.64% to $1.3376

- CAD added 0.43%, trading at C$1.38 per USD

Oil rebounds as demand outlook improves

Oil prices rallied sharply following a steep drop that had sent benchmarks to four-year lows. Investors returned to the market on signs of recovering demand in Europe and China. Additional support came from a reported decline in US output and persistent geopolitical tensions in the Middle East, reviving interest in crude.

Closing prices:

- WTI (US): +3.43% ($1.96), ending at $59.09 per barrel

- Brent (North Sea): +3.19% ($1.92), closing at $62.15 per barrel

The market has partially clawed back losses from a recent panic sell-off driven by fears of increased OPEC+ output. Focus now shifts to the short-term balance between global supply and demand.

Gold loses shine as risk appetite dulls safe haven

Amid improving sentiment surrounding US-China trade talks, investors have started to rotate out of safe-haven assets. The shift has taken a toll on precious metals, with gold now coming under pressure after surging the previous day.

Current precious metals market snapshot:

- Spot gold: down 1.2% to $3,388.67 per ounce (as of 02:25 GMT)

- US gold futures: –0.7% to $3,397.70

Traders are also reconsidering their gold positions ahead of the upcoming Fed decision. Despite a near 3% gain earlier this week, the yellow metal has pulled back, reflecting shifting sentiment.

Silver and platinum also retreat as market cools

As gold loses traction, other precious metals are following suit. Silver, often seen as gold's shadow, has slipped in tandem, while platinum and palladium continue to decline on weak industrial demand.

Precious metals roundup:

- Silver: –0.9% to $32.93 per ounce

- Platinum: –0.6% to $979.07

- Palladium: –0.4% to $970.28

The precious metals market remains highly sensitive to macroeconomic cues and interest rate expectations. If the Fed signals a hold on rates, metals may claw back some losses. If not, further pressure is likely.