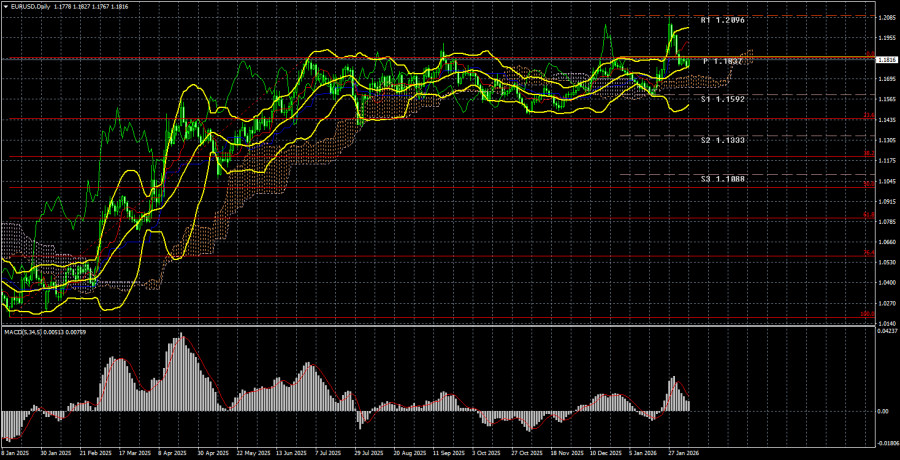

The EUR/USD currency pair has largely remained stagnant throughout the current week. It's difficult to determine the cause, as there have been numerous important events and reports. However, much of this news has turned out to be uninteresting, leading traders to prefer waiting for the NonFarm Payrolls and unemployment report, which has been postponed to the following week. Overall, the upward trend for 2025 has resumed, as shown on the daily timeframe. After a strong upward surge, the price has retraced to the upper boundary of the sideways channel that it spent seven months within. Recall that the edges of this channel were at levels of 1.1400 and 1.1830. It is worth noting that it is common for the price to return to one of the channel boundaries after breaking out of the channel, bounce off that boundary, and continue the main movement. Thus, even after a strong correction, we maintain a bullish outlook.

What can influence the EUR/USD pair next week? In recent weeks, the market has virtually ignored all events related to the European Union. Traders are prepared to react only to "super-important" news and do not wish to dissipate their focus on trivial matters. There will be three super-important events next week, but none involve a speech from Christine Lagarde, which will likely not bring anything new just days after the European Central Bank meeting...

The first two events are the notorious NonFarm Payrolls and the unemployment rate. Last week, only ADP and JOLTS from the labor market report were published. In our view, even these secondary report values could send the dollar into another downturn. For example, the JOLTs report showed that the number of job openings was 0.7 million fewer than analysts had predicted. Obviously, you cannot confidently assess the labor market's state solely on job openings, but they are one piece of the overall puzzle. The ADP report, which serves as an alternative to the Nonfarm Payrolls, showed an abysmal 22,000 new jobs in the private sector. It is likely unnecessary to mention that this is a super-low figure.

In reality, the values for the NonFarm Payrolls and ADP reports almost always differ, and the ADP report is not the most accurate. However, certain conclusions can still be drawn from it. These conclusions are not flattering. The fact that the market ignored these reports is merely another gift to the dollar. The market has chosen to wait for the main labor market reports scheduled for the following Wednesday.

According to forecasts, the number of NonFarm Payrolls in January may reach 70,000. We should immediately note that even 70,000 new jobs are few. Even if this value is exceeded, attention should also be paid to the adjustments of the values from the two previous months. As for the unemployment rate, various forecasts suggest it will be 4.4-4.5%. Overall, strong data on NonFarm Payrolls and the absence of rising unemployment could support the dollar.

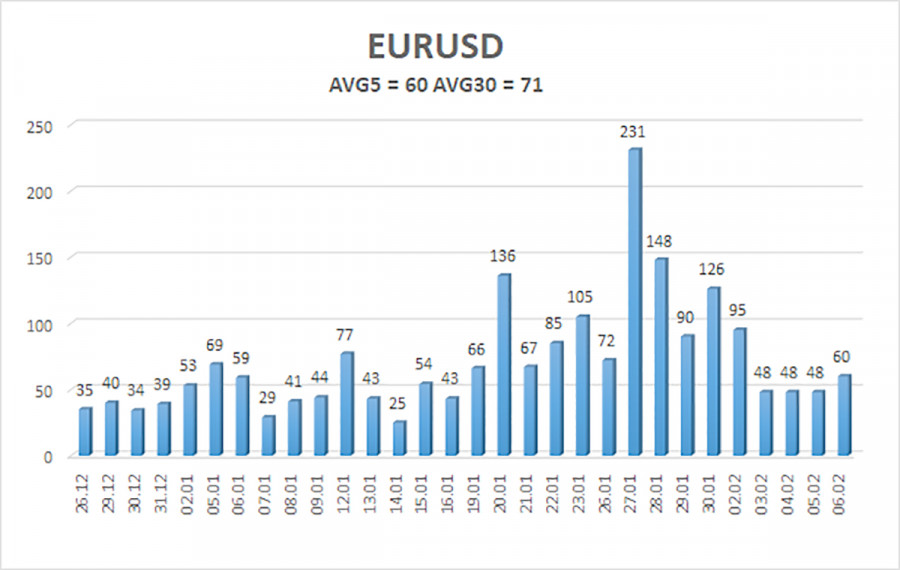

The average volatility of the EUR/USD currency pair over the last 5 trading days, as of February 8, is 60 pips and is characterized as "average." We expect the pair to trade between 1.1756 and 1.1876 on Monday. The upper linear regression channel is oriented upward, indicating further euro growth. The CCI indicator has entered overbought territory and formed two "bearish" divergences, signaling an impending correction.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1597

- S3 – 1.1475

Nearest Resistance Levels:

- R1 – 1.1841

- R2 – 1.1963

- R3 – 1.2085

Trading Recommendations:

The EUR/USD pair continues a fairly strong correction within an upward trend. The overall global fundamental backdrop remains extremely negative for the dollar. The pair spent seven months in a sideways channel, and it's likely time to resume the global trend of 2025. The dollar has no fundamental basis for long-term growth. Therefore, all the dollar can hope for is a flat or a correction. When the price is below the moving average, small shorts can be considered with a target of 1.1756 on purely technical grounds. Above the moving average line, long positions remain relevant with targets of 1.1963 and 1.2085.

Explanations for the Illustrations:

- Linear regression channels help determine the current trend. If both are pointing in the same direction, this indicates a strong trend.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and the direction in which trading should currently proceed.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the likely price channel within which the pair will trade in the coming days, based on current volatility readings.

- The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal to the opposite side is approaching.