On Thursday, the GBP/USD currency pair lost about 100 pips before the Bank of England's meeting results were announced. Either traders expected the worst from the very beginning, or insider information leaked into the market. Still, the market reacted to the "dovish" results of the meeting before the actual outcomes were known. Overall, the British central bank kept the key rate unchanged at 3.75%, which was fully in line with forecasts. So, where does the "dovishness" come from? From the fact that four members of the Monetary Policy Committee voted for a rate cut instead of two. Recall that the MPC consists of nine officials, so with just one more vote, a "dovish" decision could have been made that absolutely no traders were counting on.

Yesterday, we mentioned that the market would react to the voting results on the rate. There is no sense in that, as the decision will be taken as everyone expects. In the future, the BoE will be guided by the inflation rate when deciding on changes to monetary policy. Since inflation in Great Britain remains not just elevated but openly high, strong easing of monetary policy should not be expected. Nonetheless, the BoE was close to cutting the key rate unexpectedly.

Therefore, it was more or less logical for the British pound to trade lower on Thursday. In our view, the fate of the British pound does not depend on the BoE or British economic data. It depends on the dollar. And the fate of the dollar depends on Donald Trump and the Federal Reserve. If the Fed loses its independence in 2026, it will be at Trump's mercy. Therefore, in any case, the dollar's positions look much less attractive than the prospects for the British pound. Of course, we are still talking about a currency that is used worldwide for transactions. It cannot fall like a stone dropped off a cliff, or like the Iranian rial. But when discussing long-term prospects, we cannot foresee what would need to happen for the dollar to start appreciating.

Perhaps only Trump's impeachment could positively influence the situation with the American currency. However, there have already been several attempts to remove Trump from power during his two presidential terms. Congress was unable to make a decision during Trump's first term when both chambers were not fully Republican. What are the odds that it could succeed now, when the majority is still Republican in both chambers? Who would vote for Trump's impeachment, knowing that the likelihood of removing the president is low, and Trump's retaliation could cost them their political career? Thus, if changes are to be anticipated, they can only be after the midterm elections in Parliament in the fall of 2026.

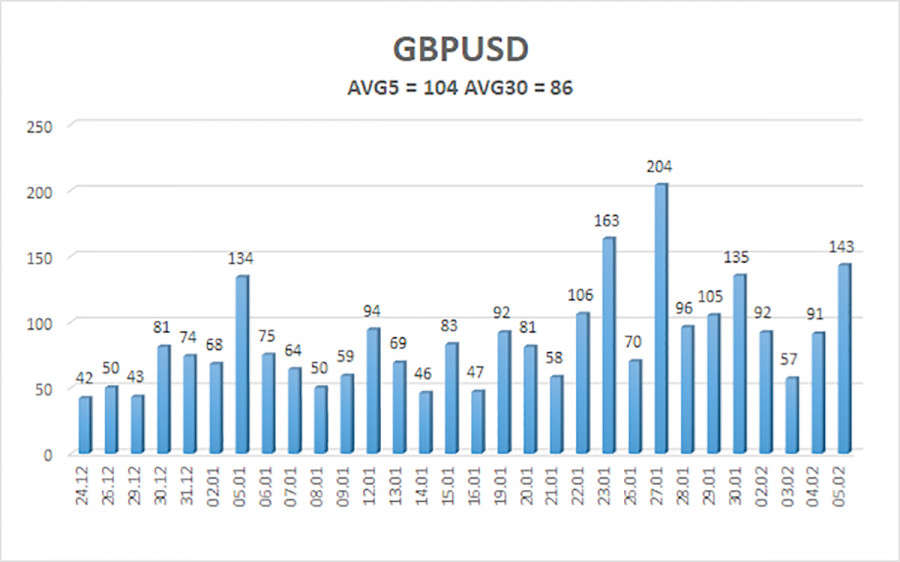

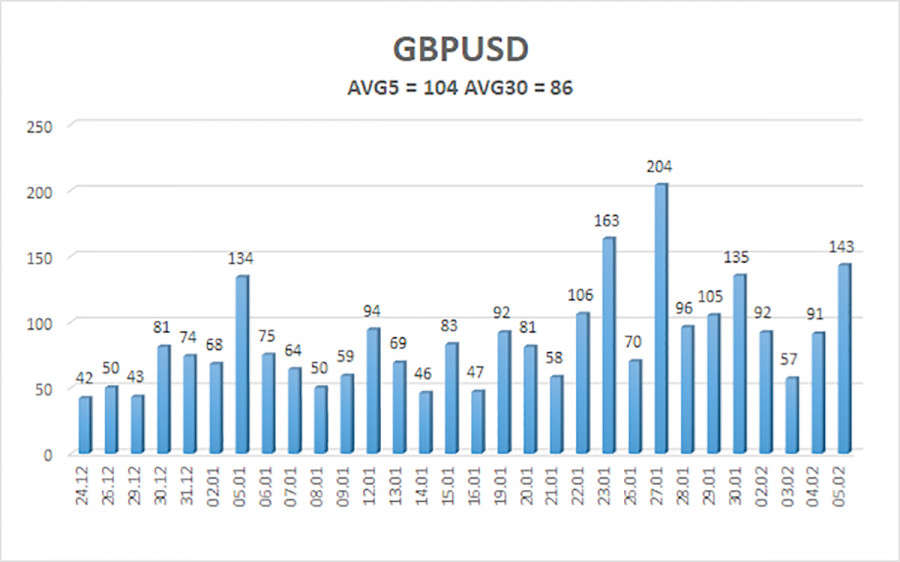

The average volatility of the GBP/USD pair over the last five trading days is 104 pips. For the pound/dollar pair, this value is considered "average." On Friday, February 6, we expect movement within the range of 1.3439 to 1.3647. The upper linear regression channel is oriented upwards, indicating a trend recovery. The CCI indicator has entered oversold territory six times over the past months and has formed numerous "bullish" divergences, constantly warning traders of an impending resumption of the upward trend. The entry into overbought territory warned of the start of a correction.

The nearest support levels:

S1 – 1.3550

S2 – 1.3428

S3 – 1.3306

The nearest resistance levels:

R1 – 1.3672

R2 – 1.3794

R3 – 1.3916

Trading Recommendations:

The GBP/USD currency pair is on track to continue its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the U.S. economy, so we do not expect the U.S. currency to grow in 2026. Even its status as a "global reserve currency" is losing significance for traders. Therefore, long positions with targets of 1.3916 and above remain relevant for the near future as long as the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3550 based on technical (correction) grounds. From time to time, the American currency shows corrections (on a global scale), but for a trend growth, it needs global positive factors.

Explanations for Illustrations:

- Linear regression channels help to determine the current trend. If both are directed the same way, it indicates a strong trend;

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction that trading should currently take;

- Murray levels are target levels for movements and corrections;

- Volatility levels (red lines) are the probable price channel within which the pair will stay in the coming days based on current volatility indicators;

- The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.