The GBP/USD pair is also continuing its decline, but today it may reverse in favor of the British pound. Credit for this, of course, goes to Donald Trump, who continues to actively promote the idea of transferring Greenland to the United States and has already moved from threats to action. New 10% trade tariffs have been imposed on countries that are most actively opposing Trump's takeover of Greenland, which belongs to Denmark. Over time, if Europe does not agree to the transfer/sale of Greenland to the United States, the tariffs could be raised to 25%. Let me remind you that Donald Trump has already imposed tariffs on many countries for the second or even third time. Each time, the US president develops certain grievances against someone in the world, which are immediately transformed into threats and tariffs. Therefore, EU countries and even the United Kingdom are no strangers to this. Recall that last year London was among the first to sign a trade agreement with Trump and showed the world that it was possible to do business with the new US president. The year 2026 has shown that London was mistaken.

Since the bullish trend in the euro remains intact, in my view the bullish trend in the pound also remains. I cannot imagine a bullish trend in the euro and, at the same time, a bearish trend in the pound. However, there are currently no workable bullish patterns. Therefore, one should wait for the formation of new bullish patterns before considering new long positions. Is it worth trading bearish patterns? Certainly, it is possible — but one should keep in mind that the current decline is classified as a corrective pullback.

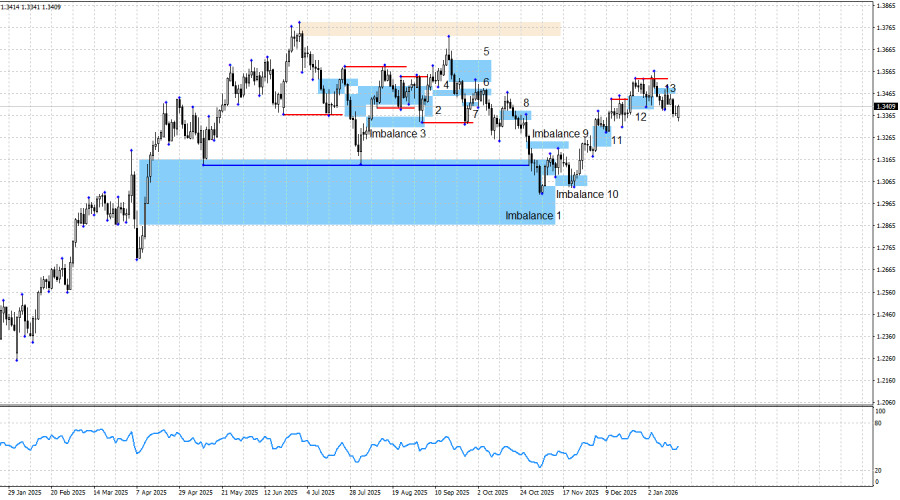

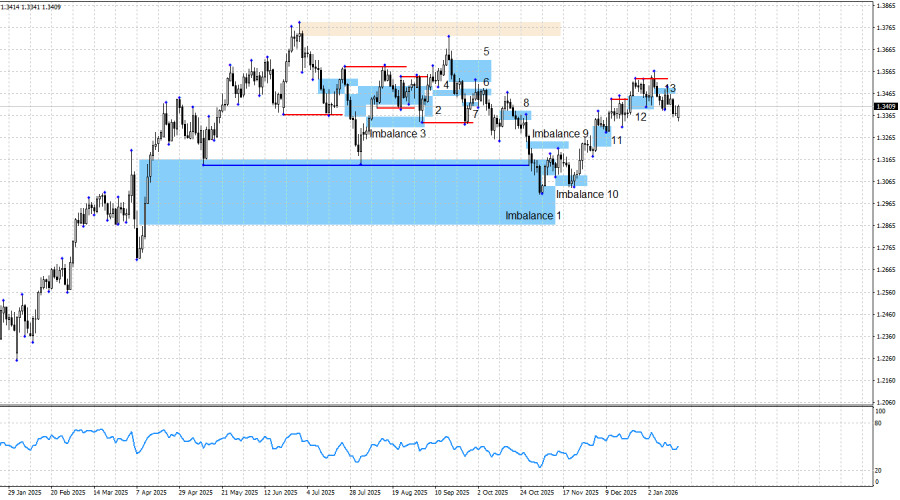

The current chart picture is as follows. The bullish trend in the pound can be considered complete, but the bullish trend in the euro is not. Thus, in the long term I still expect the pair to rise, but new bullish patterns are now needed in order to be able to trade this move.

On Monday, traders learned about new tariffs imposed on the United Kingdom, to which London has not yet responded. While the European Union is actively pulling tariff lists from its archives that were supposed to be introduced in 2025 and is developing mechanisms to counter American trade and military aggression, London has so far remained silent. Perhaps Keir Starmer's government will hold direct talks with Donald Trump in the near future, but I believe that the position of the British authorities and the British public on Greenland will not change. It does not matter whether the British would be ready to defend the island in the event of an attack. What matters is that no one simply gives away their territory or approves of such actions, understanding that today another country may lose its territory — and tomorrow it could be you.

In the United States, the overall news backdrop remains such that, in the long term, nothing but a decline in the dollar can be expected. The situation in the US remains quite difficult. The government shutdown lasted a month and a half, and Democrats and Republicans have only agreed on funding until the end of January, which is just two weeks away. US labor market data continue to disappoint. The last three FOMC meetings ended with dovish decisions, and recent data suggest that the pause in monetary easing will be short-lived. Trump's military aggression, threats against Denmark, Mexico, Cuba, and Colombia, the criminal prosecution of Jerome Powell, and new trade tariffs perfectly complement the current picture of an "American political crisis." In my view, the bulls have everything they need to launch a new offensive and return to last year's highs.

A bearish trend would require a strong and stable positive news backdrop for the dollar, which is hard to expect under Donald Trump. Moreover, the US president himself does not need a strong dollar, as the trade balance would remain in deficit. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly strong decline in September and October. Too many risk factors continue to hang over the dollar like dead weight. What would bears use to push the pound lower if a bearish trend were actually forming? If new bearish patterns appear, potential downside in the pound could be reconsidered, but at the moment there are none.

Economic Calendar for the US and the UK

- United Kingdom – Unemployment Rate (07:00 UTC)

- United Kingdom – Change in Average Earnings (07:00 UTC)

- United Kingdom – Change in Claimant Count (07:00 UTC)

The economic calendar for January 20 contains three entries that are not the most important for the market under current circumstances. The impact of the news backdrop on market sentiment on Tuesday will be negligible.

GBP/USD Forecast and Trading Advice

For the pound, the picture remains clear. The bullish advance has been halted, bears have moved into attack mode, but it is unclear how much strength they will have given the current news backdrop. I believe it will not last long.

A resumption of the bullish trend can be expected only from new bullish patterns or after liquidity sweeps of bearish swings. The nearest such swings are currently the lows of December 9 and December 17. As a potential upward target, I continue to consider the 1.3725 level, though the pound may rise much higher in 2026, especially given the events of the first three weeks of the year. If bearish patterns form, short positions are also possible, but within a bullish trend I remain a proponent of buying rather than selling.