Trade Breakdown and Trading Advice for the British Pound

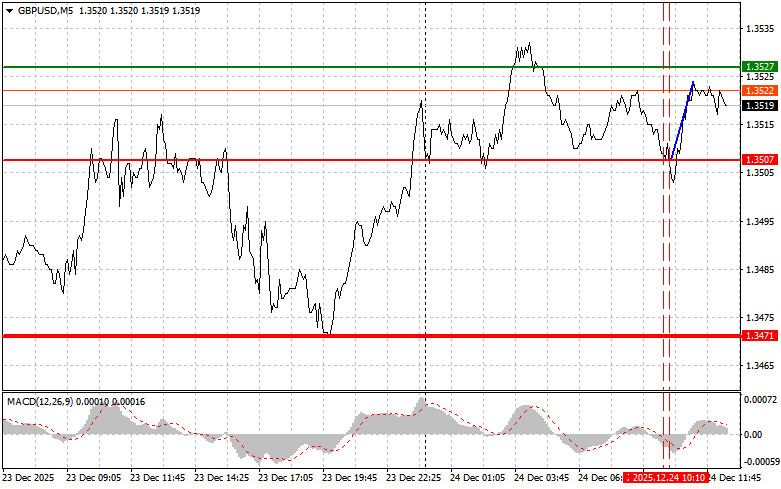

The test of the 1.3507 price level occurred at a moment when the MACD indicator had moved well below the zero line, which limited the pair's downward potential—especially within the context of an uptrend. The second test of 1.3507 took place when the MACD was in the oversold zone, which led to the implementation of Buy Scenario No. 2 for the pound. As a result, the pair rose by 15 points.

Against the backdrop of a lack of any UK statistics, the British pound managed to hold its ground, showing only a slight rise against the U.S. dollar. This can be explained by the general sluggishness of trading ahead of the Christmas holidays, when market liquidity declines and investors prefer to lock in profits rather than open new positions. The absence of economic news from the UK left the pound sterling without clear guidance, allowing it to consolidate within a narrow range.

In the second half of the day, we are expecting data on weekly initial jobless claims in the United States. These figures are particularly important, as they serve as one of the most timely indicators of labor market conditions. Economists and investors closely monitor these data to assess the current situation and forecast future trends. However, today's figures are unlikely to carry much weight. A high number of initial claims may indicate slowing economic growth and a potential rise in unemployment, which in turn could put pressure on the U.S. dollar. On the other hand, a low number of claims points to a stable or improving labor market, supporting economic growth.

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

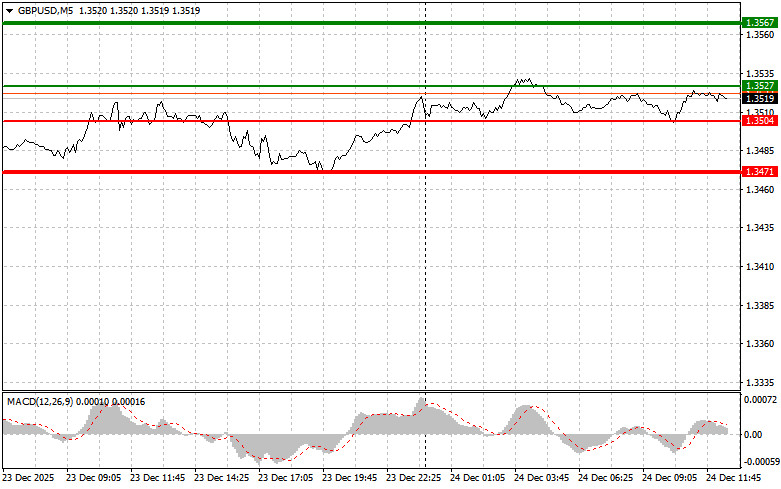

Scenario No. 1: I plan to buy the pound today if the entry point is reached around 1.3527 (green line on the chart), with a growth target at 1.3567 (the thicker green line on the chart). Around 1.3567, I will exit long positions and open short positions in the opposite direction (expecting a move of 30–35 points in the opposite direction from that level). A rise in the pound today can only be expected if U.S. data are very weak.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3504 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.3527 and 1.3567 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after a break below (or update of) the 1.3504 level (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be the 1.3471 level, where I plan to exit short positions and also immediately open long positions in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Pressure on the pound today may return only as part of a corrective move.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3527 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.3504 and 1.3471 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price where Take Profit can be set or profits can be fixed manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price where Take Profit can be set or profits can be fixed manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner Forex traders need to be extremely cautious when making decisions about entering the market. Ahead of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly—especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.