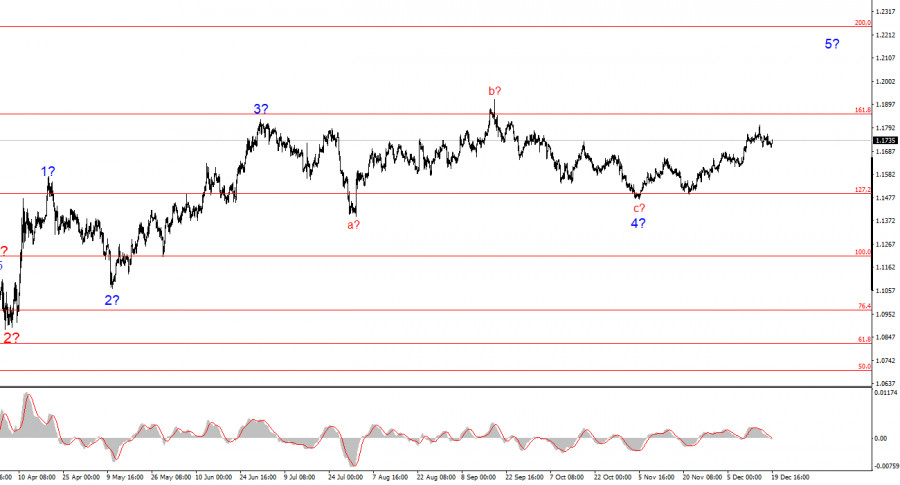

The wave pattern on the 4-hour chart for EUR/USD has changed, but overall it still remains quite clear. There is no talk of canceling the upward trend segment that began in January 2025; however, the wave structure starting from July 1 has taken on a complex and extended form. In my view, the instrument has completed the construction of corrective wave 4, which took a very non-standard shape. Within this wave, we observed exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

In my opinion, the formation of the upward trend segment has not been completed, and its targets extend as far as the 25th level. The series of waves a-b-c-d-e appears to be complete; therefore, in the coming weeks I expect the formation of a new upward wave set. We have seen the presumed waves 1 and 2, and now the instrument is in the stage of forming wave 3 or C. I expected that within this wave the instrument would rise to the level of 1.1717, which corresponds to the 38.2% Fibonacci level; however, this wave is taking on a more extended form, which is actually very positive, as in this case it may turn out to be impulsive—and along with it, the entire upward wave set.

The EUR/USD exchange rate barely changed on Friday, just as it did throughout the entire current week. Let me remind you that on Monday EUR/USD opened at 1.1739. At the time of writing this review, the rate stands at 1.1730. I am sure that this is not the kind of movement most of my readers expected at the beginning of the week. There was an enormous amount of news this week, but judging by the market's reaction, part of it was deemed unimportant, part of it bland, part of it was "checked off for the sake of form," and part of it was not traded due to contradictory data.

Let me remind you that the key reports this week were the U.S. Nonfarm Payrolls and the unemployment rate, which showed quite surprising readings. We also cannot ignore the U.S. and UK inflation reports, at the very least. The U.S. labor market delivered very strange figures: unemployment rose in November, yet payroll growth in November exceeded market expectations. Inflation slowed in the U.S., and it also slowed in the UK. The ECB and the Bank of England meetings ended exactly as market participants expected. The Bank of England and the Fed effectively received a "green light" from inflation for further policy easing.

In my view, the narrowing of the monetary policy divergence between the ECB and the Fed in 2026 will play a key role in the further weakening of the U.S. dollar. The construction of the upward trend segment is not complete, which is evident on any higher-timeframe chart. Therefore, neither the news background nor the wave count provides grounds to expect a decline. Over the past six months, the market has been squeezed between the levels of 1.1490 and 1.1853, which correspond to the 127.2% and 161.8% Fibonacci levels (bottom chart). Essentially, this is a sideways range. When it is completed, I expect the upward trend segment to resume.

General Conclusions

Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors contributing to the long-term decline of the U.S. dollar. The targets of the current trend segment may extend as far as the 25th figure. The current upward wave set is beginning to develop, and one would like to believe that we are now observing the formation of an impulsive wave set that is part of the global wave 5. In this case, growth should be expected with targets near 1.1825 and 1.1926, which correspond to the 200.0% and 261.8% Fibonacci levels.

On a smaller timeframe, the entire upward trend segment is visible. The wave count is not the most standard, as the corrective waves are of different sizes. For example, the higher-degree wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. Let me remind you that it is best to identify clear and understandable structures on charts rather than rigidly tying everything to each individual wave. At present, the upward structure raises no doubts.

Core Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are difficult to trade and often signal changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is no and cannot be 100% certainty about the direction of movement. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.