The EUR/USD pair has been declining for the eighth consecutive day, and such steady daily losses raise the question of what has caused this sharp shift in market sentiment. In my view, there is no clear answer. Traders are left to speculate why the U.S. dollar has been strengthening for a week and a half, ignoring chart patterns and many fundamental developments. It is worth recalling that just last week, the annual Nonfarm Payrolls report and the inflation rate pointed more toward dollar weakness than strength. A possible U.S. attack on Iran is also unlikely to be a positive factor for the dollar, as America could find itself in a state of open conflict for at least several weeks. Growing political pressure on Donald Trump is likewise not a clear reason to buy the dollar. Overall, the market situation remains ambiguous.

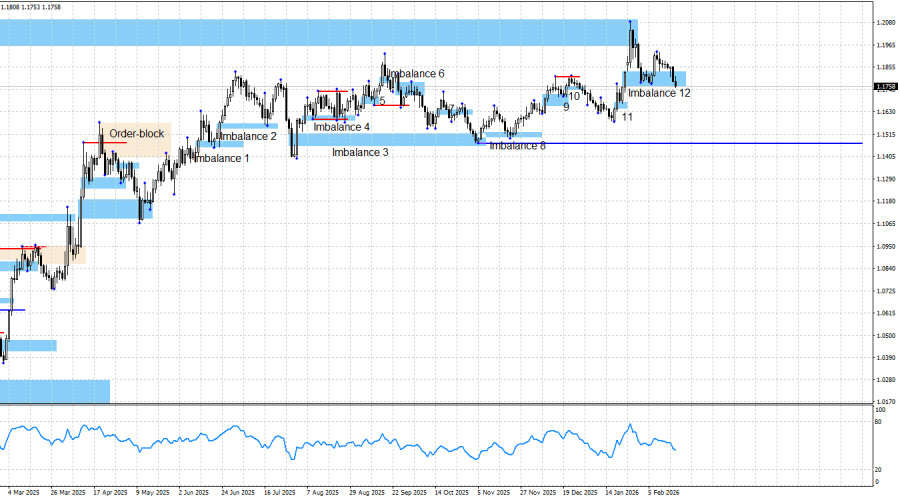

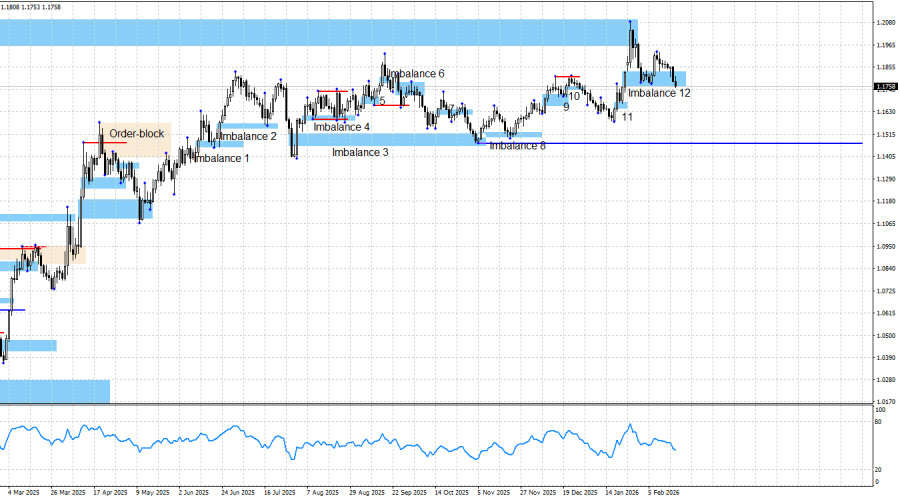

As early as today, the last "bullish" imbalance (No. 12) could be invalidated. We never saw a second reaction to this pattern, so there were no grounds for opening new long positions. There is still the possibility of liquidity being taken from the February 6 low, but this bullish scenario is also fading. This week, not many news events supported the bears, yet pressure on EUR/USD has persisted for eight days.

The chart structure continues to signal bullish dominance. The bullish trend remains intact. At present, the pair is close to setting aside the bullish scenario for a while, but Imbalance 12 has not yet been invalidated. In any case, there are currently no bearish patterns from which traders could open short positions. And as noted, the overall trend remains bullish.

Thursday's news background was practically nonexistent. Therefore, today's decline may be linked only to market expectations regarding Federal Reserve and ECB monetary policy, geopolitics (Iran), and politics (U.S. elections, potential impeachment of Trump, and the president's approval rating falling to 27%). None of these factors is unambiguous.

Bulls have had sufficient reasons to resume their advance for the past six to seven months, and those reasons are not diminishing. These include dovish prospects for FOMC monetary policy, Donald Trump's broader policies (which have not changed recently), U.S.–China tensions (with only a temporary truce in place), public protests in the U.S. under the "No Kings" banner, labor market weakness, the autumn government shutdown (which lasted a month and a half), the February shutdown, U.S. military actions toward certain states, criminal proceedings against Jerome Powell, tensions surrounding Greenland, and strained relations with Canada and South Korea. In my opinion, further growth of the pair would therefore be consistent with these factors.

I still do not believe in a bearish trend. The news background remains difficult to interpret in favor of the dollar, so I do not attempt to do so. The blue line marks the price level below which the bullish trend could be considered complete. Bears would need to push the pair down about 280 points to reach it, which still appears challenging given the current news environment and the absence of any bearish patterns on the chart. The nearest upside target for the euro had been the weekly bearish imbalance at 1.1976–1.2092, formed in June 2021. That pattern has now been fully filled. Above it, two levels stand out: 1.2348 and 1.2564 — the two peaks on the monthly chart.

News Calendar for the U.S. and the Eurozone:

Eurozone

- Speech by ECB President Christine Lagarde (00:00 UTC)

- Germany Manufacturing PMI (08:30 UTC)

- Germany Services PMI (08:30 UTC)

- Eurozone Manufacturing PMI (09:00 UTC)

- Eurozone Services PMI (09:00 UTC)

United States

- Core Personal Consumption Expenditures (13:30 UTC)

- Q4 GDP Change (13:30 UTC)

- Personal Income/Spending (13:30 UTC)

- Manufacturing PMI (14:45 UTC)

- Services PMI (14:45 UTC)

On February 20, the economic calendar contains numerous entries, particularly the EU PMIs and U.S. GDP data. The impact of the news background on market sentiment on Friday may persist throughout the day.

EUR/USD Forecast and Trader Advice:

In my view, the pair remains in the process of forming a bullish trend. Although the broader news background favors the bulls, bears have repeatedly launched attacks in recent months. Nevertheless, I do not see realistic reasons for the start of a bearish trend.

From Imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In each case, we saw some upward movement, and the bullish trend has remained intact. A new bullish signal later emerged from Imbalance 11, allowing traders to open long positions targeting 1.1976. That target was reached. Last week, another bullish signal formed in Imbalance 12, but the pair is now close to invalidating it. The formal targets remain 1.2348 and 1.2564, yet new bullish signals are now required to justify new positions.