The EUR/USD pair is in the process of declining for the seventh consecutive day. Once again, we are seeing an extremely slow decline in the European currency's quotes, as if the market truly does not want to sell the euro and buy the dollar, yet something is forcing it to do so. In my view, any dollar growth under the current circumstances is short-term. At the moment, the market does not see sufficient grounds for a new wave of selling the U.S. currency, so the dollar is gradually strengthening. The ECB, amid declining inflation, may cut interest rates in 2026, but even this reason appears somewhat far-fetched. The key issue is the weakness of the current move, which does not allow us to conclude that the market has clear intentions to sell the euro and buy the dollar.

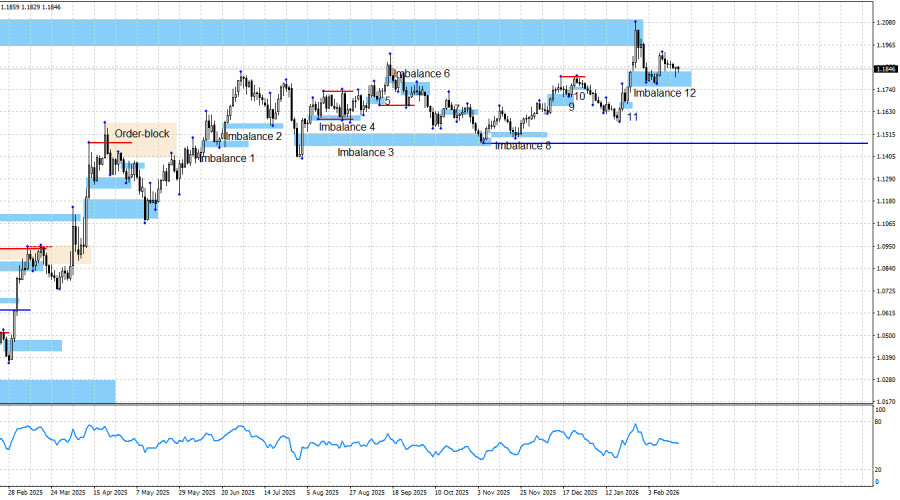

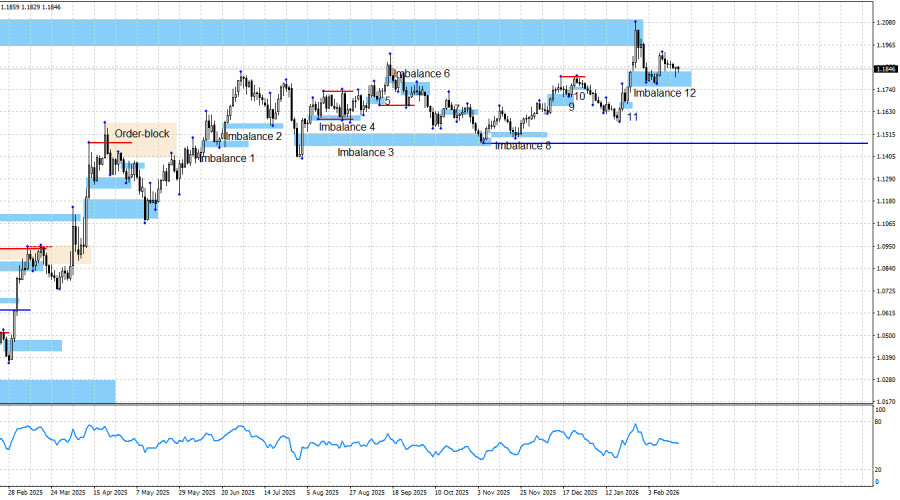

On the daily chart, it is clearly visible that almost any upward movement over the past 12–13 months has been stronger and sharper than any decline. For example, from December 24 to January 16, the dollar also rose and managed to gain 200 points. But from January 19 to January 27, it collapsed by 450 points. The "bullish" imbalance 12 has not been invalidated. Another "bullish" imbalance from February 9 has also not been invalidated. There are still no "bearish" patterns, and the news background provides rather questionable support to the dollar.

The graphical picture continues to signal bullish dominance. The bullish trend remains intact. A bullish signal was formed in imbalance 11, and shortly after, another bullish signal appeared in imbalance 12. Thus, traders can keep long positions open until the current patterns are invalidated or bearish signals are formed. Even in that case, I would not expect significant growth in the U.S. currency.

On Wednesday, the news background had no meaningful impact on traders' sentiment. Three fairly significant reports were released in the United States, which certainly caused some movement in the pair—but only slightly. The technical picture remains unchanged, and I still expect another bullish price reaction to the last two imbalances.

Bulls have had sufficient reasons for a new offensive for the past 6–7 months, and with each passing week, those reasons are not becoming fewer. These include the (in any case) dovish outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the U.S.–China confrontation (where only a temporary truce has been reached), protests by the American public against Trump under the slogan "No kings," weakness in the labor market, the autumn government shutdown (which lasted a month and a half), the February shutdown, U.S. military aggression toward certain countries, criminal prosecution of Powell, the "Greenland confusion," and worsening relations with Canada and South Korea. Thus, in my opinion, further growth of the pair would be entirely logical.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I am not attempting to do so. The blue line indicates the price level below which the bullish trend could be considered finished. Bears would need to push the price down about 360 points to reach it, which still seems unachievable given the current news background and the technical picture, where there is not a single bearish pattern.

The nearest growth target for the euro was the bearish imbalance at 1.1976–1.2092 on the weekly chart, formed back in June 2021. This pattern has now been fully filled. Above that, two levels can be identified: 1.2348 and 1.2564. These levels correspond to two peaks on the monthly chart.

News Calendar for the U.S. and the Eurozone:

United States – Change in Initial Jobless Claims (13:30 UTC).

On February 19, the economic calendar contains only one entry, which can hardly be called important. The influence of the news background on market sentiment on Thursday may be minimal.

EUR/USD Forecast and Trading Tips:

In my opinion, the pair remains in the stage of forming a bullish trend. Despite the fact that the news background favors the bulls, bears have regularly launched attacks in recent months. Nevertheless, I see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In all cases, we saw certain growth, and the bullish trend has persisted. Subsequently, a new bullish signal was formed from imbalance 11, again allowing traders to open long positions with a target of 1.1976. The target was reached. Last week, another bullish signal was formed in imbalance 12, giving traders yet another opportunity to buy the pair. The formal targets are 1.2348 and 1.2564. This signal has not been invalidated.