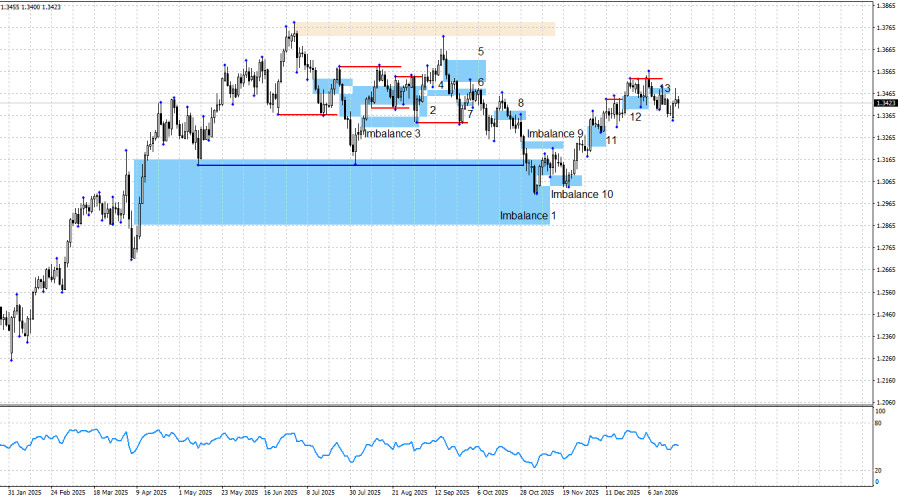

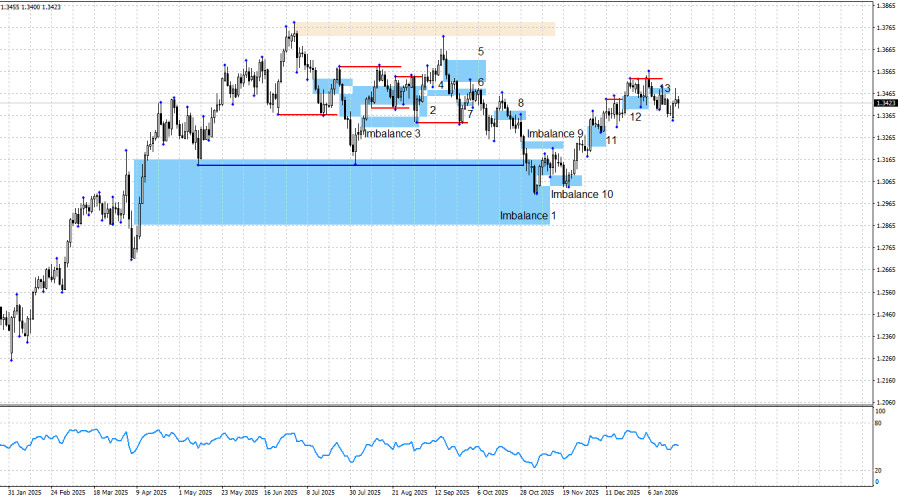

The GBP/USD pair reversed in favor of the pound, but the rally faded very quickly. Traders continue to build long positions in the European currency, but seem to have forgotten about the British pound. The current situation is ambiguous. In my view, the pound should continue its upward move; however, there are no technical reference points at the moment, and the bullish impulse faded before it really began. Still, this is not the biggest problem for traders.

Let me remind you that trading should not be based on news, which may have one tone today and a completely different one tomorrow. Nothing prevents the EU and the United Kingdom from once again making concessions to Donald Trump, after which the conflict could be considered resolved. And there are countless ways to "make a bow." Europe does not have to give up Greenland entirely; for example, it could lease it. Or it could simply allow U.S. military bases to be deployed on the island. As a result, the tariffs announced by Trump could be canceled ten more times before February 1. Let me also remind you that the bullish impulse in the euro is stronger, yet even there no patterns have formed from which long positions could be opened this week.

Since the bullish trend in the euro remains intact, in my opinion the bullish trend in the pound also remains intact. I cannot imagine a bullish trend in the euro occurring simultaneously with a bearish trend in the pound. However, there are no workable bullish patterns at the moment, and there are also few chances of them forming this week. There have been no liquidity sweeps and no moves that could lead to the formation of areas of interest. In the long term, I still expect the pair to rise.

On Monday, traders learned about new tariffs against the United Kingdom, which were met with condemnation in London. Prime Minister Keir Starmer said he would soon hold direct talks with Donald Trump and try to find a way out of the situation. However, it is Denmark—or at least the European Union—that should be resolving issues with Trump, not the United Kingdom. Economic data this week could have pleased bullish traders, had they not ignored it. Just today, it became known that inflation rose in December, which immediately erased expectations of further monetary easing by the Bank of England. However, the pound did not want to continue rising, and at the same time found no reasons to begin a new decline.

In the United States, the overall news background remains such that nothing but a decline in the dollar can be expected in the long term. The situation in the U.S. remains quite difficult. The government shutdown lasted a month and a half, and Democrats and Republicans agreed on funding only until the end of January, which is just two weeks away. U.S. labor market data continue to disappoint. The last three FOMC meetings ended with dovish decisions, and recent data suggest that the pause in monetary easing will be short-lived. Trump's military aggression, threats against Denmark, Mexico, Cuba, and Colombia, the initiation of criminal proceedings against Jerome Powell, and new trade tariffs all perfectly complement the current picture of an "American political crisis." In my view, the bulls have everything they need to launch a new offensive and return to last year's highs.

A bearish trend would require a strong and stable positive news background for the dollar, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as the trade balance would remain in deficit in that case. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly strong decline in September and October. Too many risk factors continue to hang like dead weight over the dollar. How exactly do the bears plan to push the pound lower if, under current conditions, a bearish trend is supposedly forming? If new bearish patterns appear, a potential decline in the pound sterling can be reconsidered, but at the moment there are none.

News Calendar for the U.S. and the United Kingdom:

- United States – GDP growth rate, Q3 (13:30 UTC).

- United States – Initial jobless claims (13:30 UTC).

- United States – Core Personal Consumption Expenditures Price Index (15:00 UTC).

- United States – Personal income and spending (15:00 UTC).

On January 22, the economic calendar contains four events. The impact of the news background on market sentiment on Thursday may be seen in the second half of the day.

GBP/USD Forecast and Trading Advice:

For the pound, the picture remains clear; only patterns and signals are missing. The bullish advance has been halted, and the bears have gone on the offensive—but how long they can sustain it under the current news background is unclear. I believe not for long.

A resumption of the bullish trend can only be expected from new bullish patterns or after liquidity sweeps from bearish swings. The nearest such swings are currently the lows of December 9 and December 17. As a target for potential growth, I continue to consider the 1.3725 level, but the pound may rise much higher in 2026, especially given the events of the first three weeks of the year. If bearish patterns form, short positions are also possible; however, within a bullish trend, I am a supporter of buying rather than selling.