The GBP/USD currency pair also traded with a minimal decline. There was little news on the day, so the market decided to take a breather before the next upward move. In the previous EUR/USD article, we began examining the problem facing the U.S. dollar in light of Donald Trump's actions and statements. Let's continue.

We've already noted that the market no longer trusts Trump and is tired of his daily changing rhetoric. On Monday, Trump announced that he would postpone raising tariffs on the European Union to 50% until July 9. But what does that give the market, the EU, or traders? From our point of view—nothing. Trump decided to provide Brussels with a little more time, but who says the EU will make an offer that Washington can't refuse? If the EU is ready to meet all of Trump's demands and ultimatums, why hasn't it done so already? Two of the three "grace months" have already passed.

We believe the European Union is taking every opportunity to delay the tariff hikes. Why not? Extra time for negotiations allows for the possibility that Trump may reconsider, heed the advice of independent economists, or respond to new macroeconomic data that indicates worsening conditions. Let's remember that many experts are forecasting not just a slowdown in the U.S. economy but a structural one—along with a loss of credibility, declining interest from global investors, and the erosion of the dollar's status as the world's reserve currency. In this sense, time is working against Trump. The longer the talks drag on, the more the U.S. economy slows down.

We should also recall that the European economy is only affected by U.S. tariffs, while the American economy is hurt by Trump's tariffs on 75 countries and the retaliatory tariffs. So, as time passes, conditions worsen for Trump and American consumers and businesses. It's noteworthy that Brussels (like Beijing) is ready to sign a fair agreement. For example, a proposal has already been made to eliminate all industrial tariffs on both sides. Naturally, that doesn't suit Trump. Despite what he claims in interviews, he doesn't want a fair deal—he wants a deal that will fill the U.S. budget and allow him to proudly declare that he saved the economy with a wave of his hand.

Will the EU and other countries agree to Trump's draconian ultimatums? We highly doubt it. Even if trade deals are signed, they won't happen in just a few months. Recall how long the trade talks between Beijing and Washington lasted during Trump's first term. Recall how many years it took for London and Brussels to negotiate a trade agreement. Yes, Trump wants to sign favorable deals quickly, but these deals are only favorable to him—not to the other parties. So now we can say that the dollar may enter a prolonged decline, and even positive news about the global trade war is unlikely to lead to a strong dollar recovery. Nobody wants the dollar. Trust takes years to build and only months to destroy. Trump has proven that.

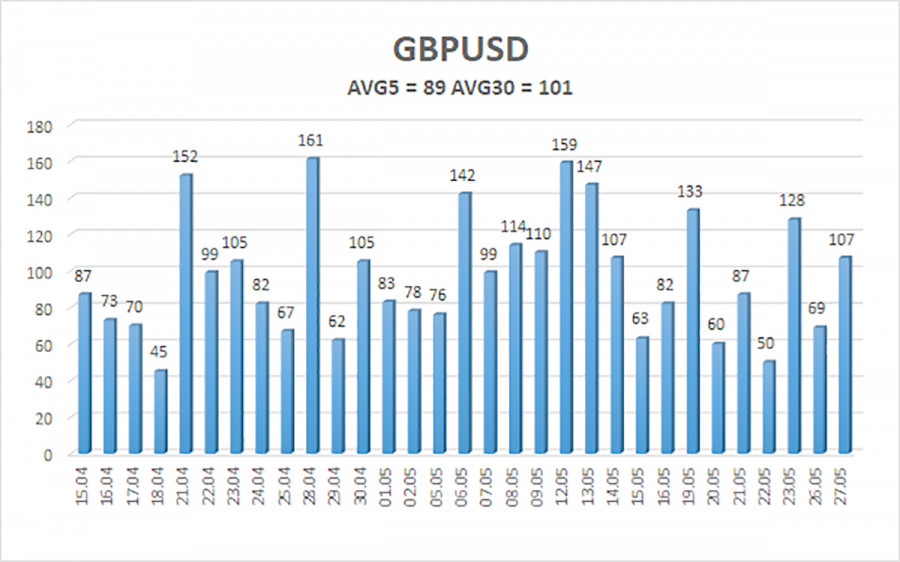

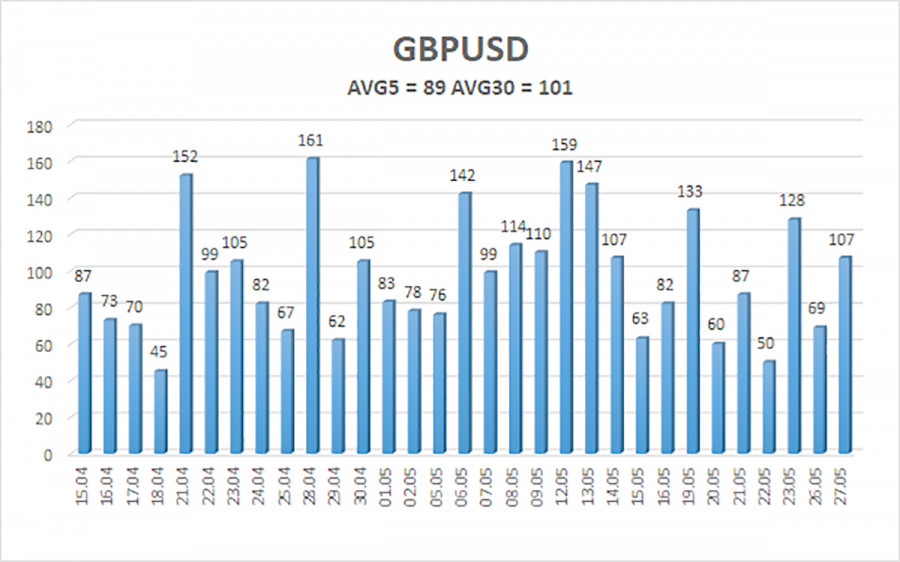

The average volatility of the GBP/USD pair over the past five trading days is 89 pips, which is considered "moderate" for the pound/dollar pair. On Wednesday, May 28, we expect movement within the range of 1.3413 to 1.3591. The long-term regression channel is directed upward, indicating a clear uptrend. The CCI indicator has not recently entered extreme zones.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair maintains its uptrend and continues to rise regardless of external factors. The de-escalation of the trade conflict has started and stalled again, but the market's aversion to the dollar remains. Every new decision by Trump is perceived negatively by the market. As a result, long positions are possible with targets at 1.3550 and 1.3591 if the price remains above the moving average. A move below the moving average line would allow for considering short positions with a target of 1.3306. The U.S. dollar may show occasional corrections. Fresh signs of real de-escalation in the global trade war are needed for a more substantial rally.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.