Trade Analysis and Tips for the Euro Currency

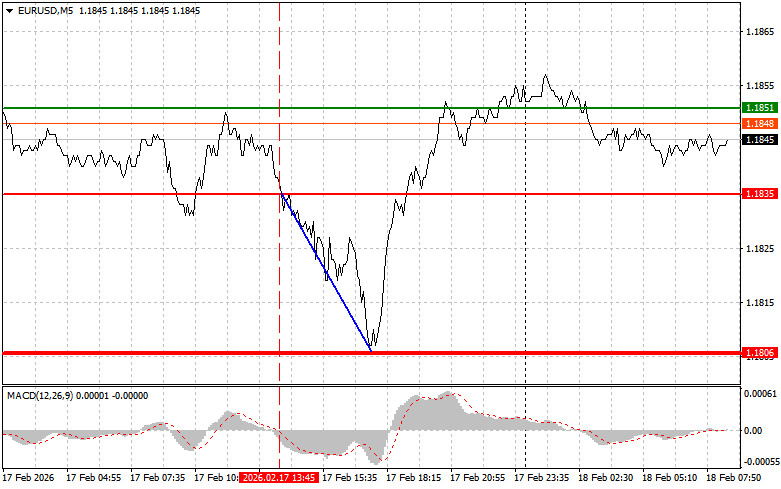

The test of the price at 1.1835 coincided with the moment when the MACD indicator was just starting to move below the zero mark, confirming a valid entry point for selling the euro. As a result, the pair dropped by 30 pips.

Yesterday, the Empire Manufacturing Index, which reflects business activity in New York State, rose sharply, surpassing economists' forecasts. This was a positive signal for the dollar. Many expect the trend of the dollar strengthening could continue if new economic reports from the U.S. continue to confirm the strength of the American economy.

Today's morning economic events will focus on the consumer price index (CPI) for France. The CPI data for France is usually under traders' scrutiny but often has little impact on the currency market. Only a strong divergence from forecasts, whether exceeding or failing to reach expected values, will trigger an immediate response in the currency market. If the inflation level exceeds expectations, it could heighten concerns about a resurgence in price growth. Conversely, if the CPI figures fall below expectations, which is more likely, this could strengthen the European Central Bank's position regarding its interest rate policy.

As for my intraday strategy, I will focus more on implementing Scenarios 1 and 2.

Buy Scenarios

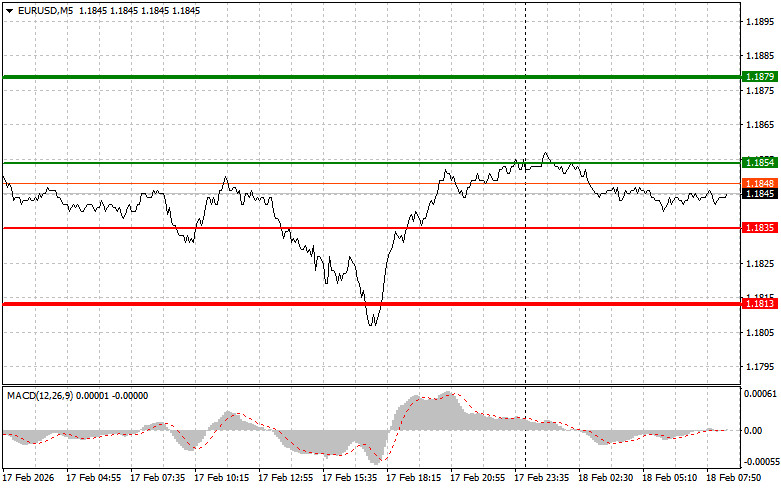

Scenario 1: I plan to buy euros today if the price reaches an entry point around 1.1854 (green line on the chart) with a target growth to the level of 1.1879. At the level of 1.1879, I intend to exit the market and sell euros in the opposite direction, expecting a movement of 30-35 pips from the entry point. Growth in the euro today can only be anticipated after strong labor market data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario 2: I also plan to buy euros today if there are two consecutive tests of 1.1835 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. Growth can be expected towards the opposite levels of 1.1854 and 1.1879.

Sell Scenarios

Scenario 1: I plan to sell euros once the level of 1.1835 (red line on the chart) is reached. The target will be the level of 1.1813, where I intend to exit the market and immediately buy in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair today will return if the reports are weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

Scenario 2: I also plan to sell euros today if the price tests 1.1854 twice in a row while the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. A decline can be expected towards the opposite levels of 1.1835 and 1.1813.

What's on the Chart:

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, as outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.