*) see also: InstaForex Trading Indicators for S&P 500 (SPX)

The US equity market began the current week in a state of elevated volatility. The S&P 500 is showing corrective weakness and is setting up the potential to close the week in negative territory. The primary driver of the pressure has been new tariff risks prompted by statements from US President Donald Trump, together with rising tensions between the US and European Union countries.

Investor focus has shifted to White House announcements on new import tariffs on goods from a number of key European states (from February 1 — 10% duties on goods from eight European countries; from June 1 — a possible increase in tariffs to 25%). The condition for lifting the measures was cited as political agreements over Greenland.

European authorities, in turn, are discussing retaliatory measures of up to €93 billion, including restrictions on US companies and the use of previously unused mechanisms of economic pressure. These events have pushed down the share prices of many large US firms that work with European suppliers and partners, amplifying overall negative investor sentiment.

The market perceives the developments as the risk of a new tariff war, which is intensifying sell?offs in manufacturing and export?oriented sectors of the US economy. The consequences of the announced tariff policy could have far?reaching economic effects:

- Increase in prices for consumer goods imported from Europe.

- Higher production costs for US corporations dependent on European raw materials and components.

- Possible escalation of confrontation between the US and the EU, leading to further erosion of confidence and slowing global economic growth.

These factors make market prospects highly unpredictable, increasing stress on financial institutions and investment portfolios.

Reaction of equity and debt markets

The negative fundamental backdrop has affected not only equities but also the bond market:

- 10?year US Treasury yield rose to 4.25%,

- 20?year yields climbed above 4.79%,

- 30?year bonds approached 4.84%.

Government bond yields are rising along with the overall level of market anxiety, showing a trend toward higher long?term Treasury yields. Rising yields increase pressure on equities by raising borrowing costs and reducing the appeal of risky assets, reflecting investors' tendency to protect capital by shifting into safer instruments.

Fed's role and rate expectations

Although the tariff issue has moved to the front burner temporarily, investors continue to factor in the Federal Reserve. On one hand:

- tariffs were previously the reason the Fed refrained from rapid easing;

- the regulator will announce a rate decision as soon as next week.

On the other hand:

- market expectations are growing that the Fed may accelerate its easing cycle in the second half of the year;

- discussion of a possible change in Fed leadership increases uncertainty but so far does not alter the baseline scenario of policy remaining in place until mid-year.

This balance of factors is producing an unstable but manageable correction in the S&P 500 index.

Technical analysis

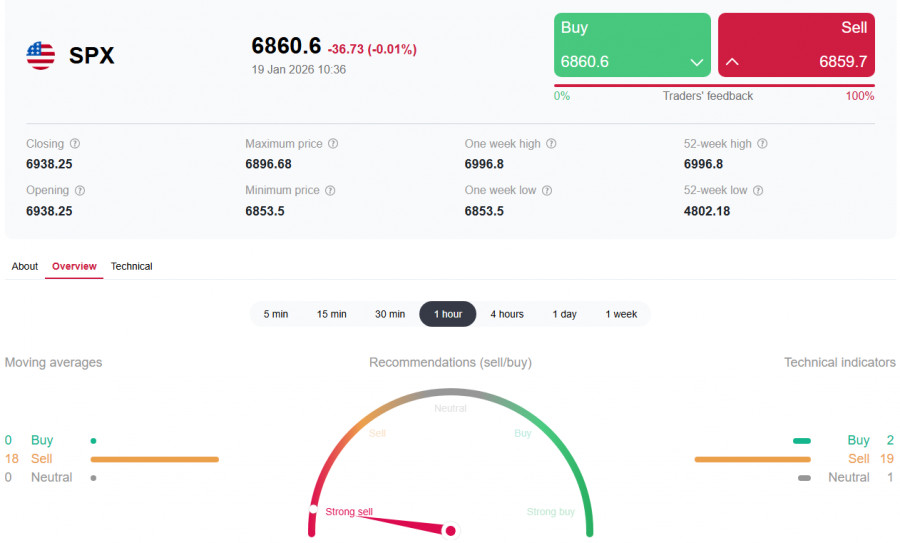

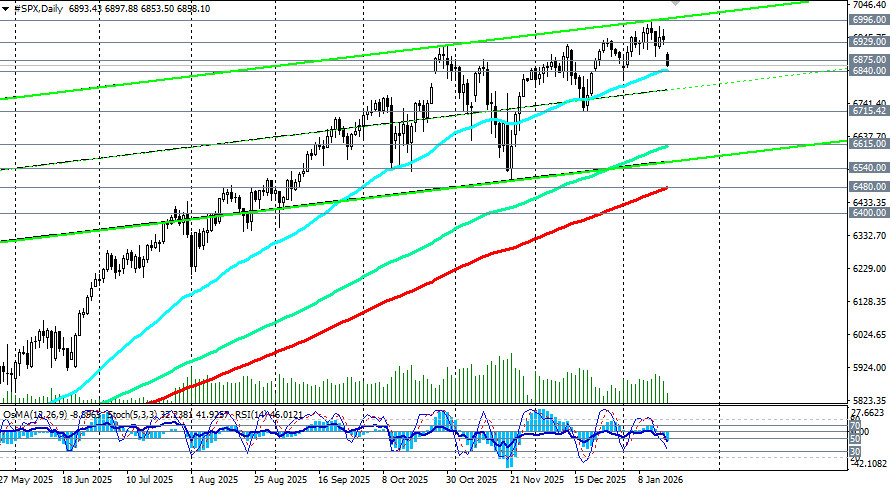

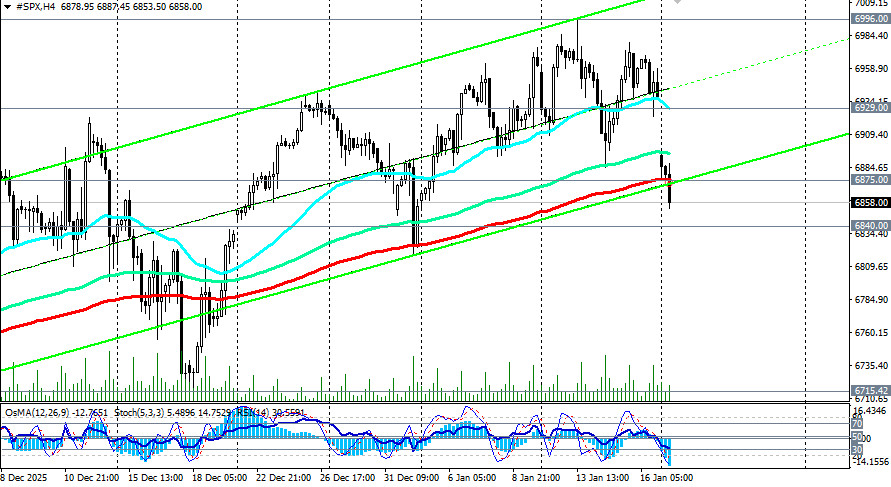

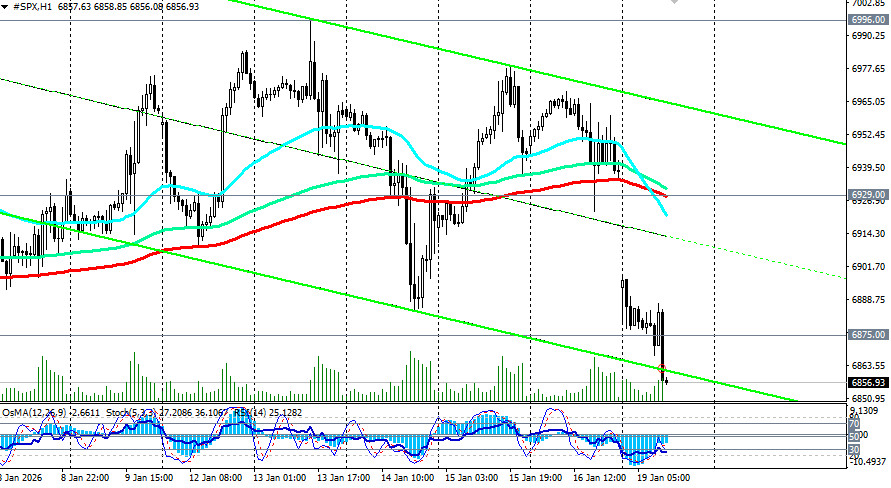

Futures on the broad US market index S&P 500 are correcting toward 6855.00 in the first half of the European session, moving toward the key support level of 6,840.00 (EMA50 on the daily chart) after today's trading opened with a sizeable price gap.

The price has broken the important short?term support level of 6,875.00 (EMA200 on the 4?hour chart), and technical indicators (in our case — RSI, OsMA, Stochastic) on timeframes from 1?hour to daily have turned bearish. A break of the 6,840.00 support level could intensify pressure and lead to a decline into the 6,715.00–6,615.00 zone (EMA144 on the daily chart). Resistance is located in the 6,929.00 (EMA200 on the 1?hour chart) – 7,000.00 area, where profit?taking occurred earlier.

While the index remains above 6,840.00 (EMA50), the current move can be viewed as a correction within a broader uptrend.

Prospects and scenario development

Main scenario

If tariff rhetoric persists and yields rise:

- S&P 500 may continue to correct,

- the index will likely end this week in negative territory,

- the market will price in risks of deteriorating global trade.

Alternative scenario

If rhetoric eases and signs of de?escalation appear:

- the index could stabilize above 6,875.00,

- a return to the 6,929.00–7,000.00 range is possible,

- investor focus would shift back to corporate earnings and Fed policy.

Conclusion

The S&P 500 index is currently under pressure from geopolitical and trade risks, which increase volatility and raise investor caution. Despite the negative news flow, the market retains structural resilience, and the current decline looks like a risk?repricing phase rather than the start of a full reversal.

In the coming days, key drivers will remain tariff announcements, the EU response, and signals from the Fed, which will determine whether the correction deepens or the market finds a stabilisation point.

Forecasts and recommendations for investors

Given the overall unstable environment in global financial markets, investors are advised to exercise caution and prudence when constructing portfolios. Particular attention should be paid to asset diversification and the selection of reliable risk?hedging instruments.

There remains strong interest in defensive assets such as precious metals, which traditionally perform well during periods of elevated market uncertainty.

Thus, the coming days (and possibly months) could test the resilience of the global economy and financial institutions, underscoring the need for careful analysis of current market realities and the development of effective capital protection mechanisms.