Analysis of Trades and Tips for Trading the British Pound

The price test at 1.3564 coincided with the MACD indicator just starting to move down from the zero mark, confirming a good entry point to sell the pound. As a result, the pair dropped by more than 40 pips.

Data indicating that inflation in the UK has slowed prompted a sell-off of the British pound early in the day. The released reports showed that consumer prices in the country demonstrated an unexpected slowdown in growth, falling below economists' forecasts. This fact immediately affected the currency market, leading to a noticeable decline in the pound's exchange rate against major currencies. Strong US data led to another sell-off in GBP/USD in the afternoon.

Today, the pound may recover slightly, as nothing else significant is scheduled apart from the balance of industrial orders report from the Confederation of British Industry. This indicator reflects companies' plans for new order volumes and serves as a leading indicator of the manufacturing sector's condition. A decrease or stagnation in this index could heighten concerns about a slowdown in the British economy, which, in turn, would negatively affect the pound's exchange rate. Given that the market is already anticipating potential weakness in the pound due to recent inflation data, negative news from the manufacturing sector could trigger further selling.

As for the intraday strategy, I will lean more towards implementing scenarios #1 and #2.

Buy Scenarios

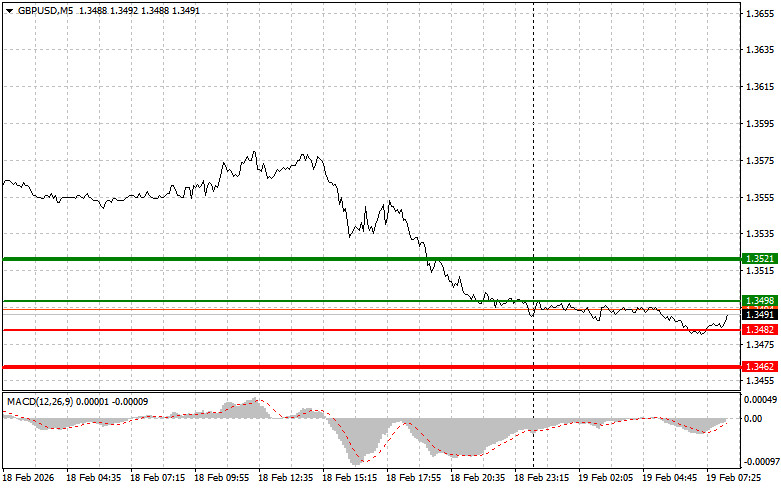

- Scenario #1: I plan to buy the pound today upon reaching an entry point around 1.3498 (green line on the chart), with a target for growth to 1.3521 (thicker green line on the chart). At the 1.3521 level, I intend to exit the long positions and sell in the opposite direction, anticipating a move of 30-35 pips from the level. Growth in the pound today can only be expected after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

- Scenario #2: I also plan to buy the pound today if the price tests 1.3482 twice in a row while the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to an upward market reversal. Growth towards opposing levels of 1.3498 and 1.3521 can be anticipated.

Sell Scenarios

- Scenario #1: I plan to sell the pound today after it breaks below 1.3482 (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the level of 1.3462, where I intend to exit the shorts and immediately buy in the opposite direction (anticipating a movement of 20-25 pips in the opposite direction from the level). Pound sellers will come into play in the event of poor data. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

- Scenario #2: I also plan to sell the pound today if the price tests 1.3498 twice in a row, when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decrease toward opposing levels of 1.3482 and 1.3462 can be anticipated.

What's on the Chart:

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, as outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.