Trade Review and Advice for Trading the British Pound

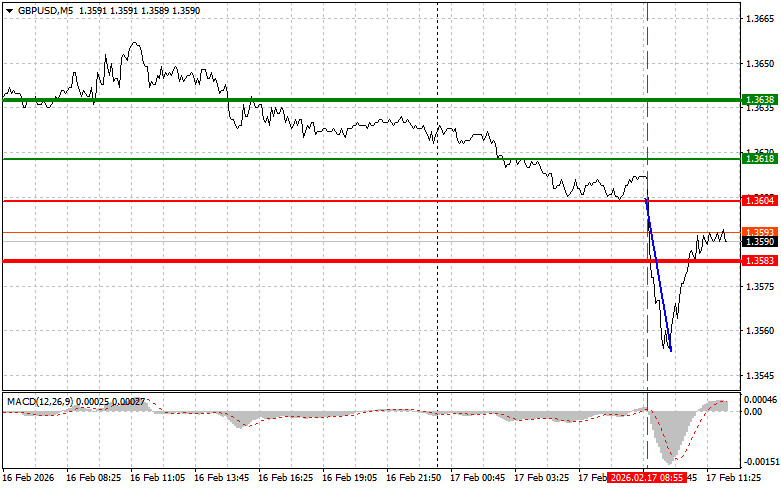

The test of the 1.3604 level occurred when the MACD indicator had just begun moving downward from the zero line, confirming a correct entry point for selling the pound. As a result, the pair declined by more than 40 points.

The rise in the UK unemployment rate to 5.2%, exceeding expert expectations, triggered weakness in the British pound. This trend was reinforced by a decline in average earnings in December of last year. The deterioration in the labor market indicates a slowdown in economic growth and raises questions about the adequacy of the Bank of England's current monetary policy. The decline in real household incomes, caused by modest wage growth and ongoing price increases, inevitably affects consumer activity. Reduced purchasing power may lead to further declines in business activity and investment, reinforcing economic stagnation.

In the second half of the day, data on weekly employment changes from ADP and the Empire Manufacturing Index are expected. The ADP report will focus on the total number of jobs created and sector-specific dynamics, which may reveal emerging economic trends. The Empire Manufacturing Index will reflect conditions in New York State's manufacturing sector, one of the country's key industrial centers. Strong data will support the dollar and renew pressure on the British pound.

As for the intraday strategy, I will primarily rely on implementing Scenarios No. 1 and No. 2.

Buy Signal

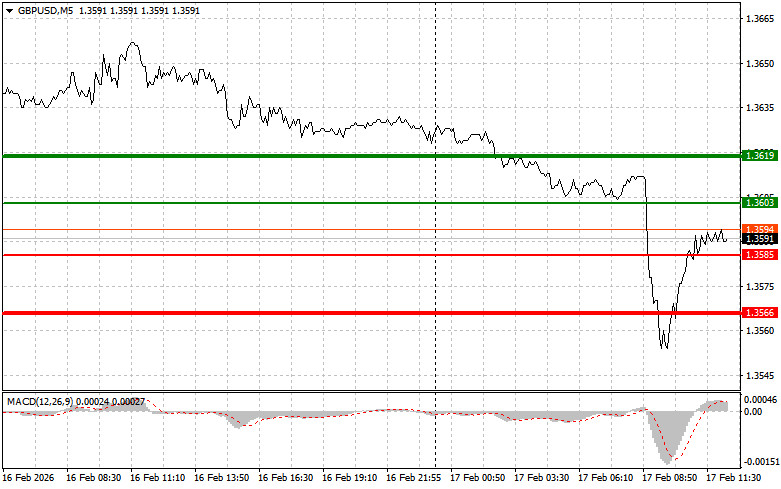

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3603 (green line on the chart), targeting growth toward 1.3619 (thicker green line on the chart). Around 1.3619, I will exit long positions and open short positions in the opposite direction, aiming for a 30–35 point move from that level. Pound growth today may occur following dovish comments from Federal Reserve representatives.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound if there are two consecutive tests of the 1.3585 level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger an upward reversal. Growth toward 1.3603 and 1.3619 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound after a break below the 1.3585 level (red line on the chart), which could lead to a quick decline in the pair. The key target for sellers will be 1.3566, where I will exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 point move from that level. Pressure on the pound may return today in the event of a hawkish stance.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound if there are two consecutive tests of the 1.3603 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward reversal. A decline toward 1.3585 and 1.3566 can be expected.

Chart Explanation

- Thin green line – entry price for buying the instrument.

- Thick green line – suggested Take Profit level or area to lock in profits, as further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – suggested Take Profit level or area to lock in profits, as further decline below this level is unlikely.

- MACD indicator – when entering the market, pay attention to overbought and oversold zones.

Important: Beginner Forex traders should make market entry decisions very carefully. It is best to stay out of the market before the release of major fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not apply proper money management and trade large volumes.

Remember that successful trading requires a clear trading plan, such as the one outlined above. Spontaneous trading decisions based solely on the current market situation are inherently a losing strategy for an intraday trader.