Analysis of Trades and Trading Tips for the British Pound

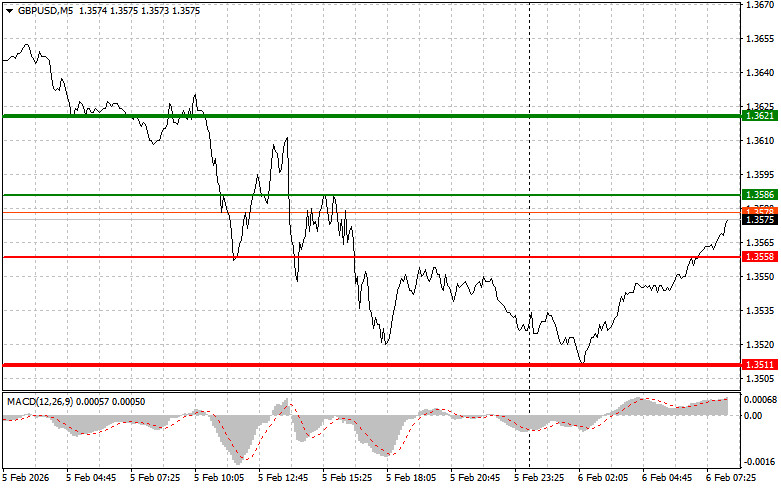

The test of the price at 1.3577 coincided with the MACD indicator just starting to move downward from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair declined by more than 50 pips.

The Bank of England kept its key interest rate unchanged yesterday but hinted at the possibility of a cut soon, which caused the British pound to drop. An important point was the statement that inflation is expected to reach the target level of 2.0% as early as April this year. This sounded like a signal of a possible change in monetary policy in the near future, which prompted a noticeable reaction in financial markets. The sharp drop in the British pound was a logical consequence of this news.

The first half of today promises to be quite interesting for the pound. This is due to the upcoming release of the Halifax house price index. This indicator traditionally serves as a benchmark for assessing the health of the British real estate market. The results of the Halifax House Price Index could shed light on the current situation in this sector, which plays a significant role in the UK economy. The data obtained may influence forecasts for consumer spending, the level of inflationary pressure, and, consequently, the central bank's decisions regarding interest rates.

Simultaneously, attention will be focused on the statements of Huw Pill, a member of the BoE's Monetary Policy Committee. Considering his recent remarks on a potential decline in inflation and a review of current policies, every word from this central bank representative takes on particular importance. Pill's speech may provide deeper insights into the MPC's priorities and forecasts, as well as prospects for further monetary policy tools. Traders will be looking for signals indicating possible timelines and conditions for further rate cuts, which will directly affect the British pound's exchange rate.

As for the intraday strategy, I will primarily rely on implementing scenarios #1 and #2.

Buy Scenarios

- Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3586 (green line on the chart), targeting a move to 1.3621 (thicker green line on the chart). At around 1.3621, I intend to exit my long positions and open short positions in the opposite direction, aiming for a move of 30-35 pips in the opposite direction from the level. Growth in the pound today can only be anticipated after strong data. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise.

- Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3558 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise can be expected to the opposing levels of 1.3586 and 1.3621.

Sell Scenarios

- Scenario #1: I plan to sell the pound today after it reaches 1.3558 (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3511 level, where I intend to exit my shorts and also buy immediately on the bounce, aiming for a move of 20-25 pips in the opposite direction from that level. Pound sellers will manifest if the pair rallies strongly towards major resistance levels. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline.

- Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3586 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline can be expected to the opposing levels of 1.3558 and 1.3511.

What's on the Chart:

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.