Trade Analysis and Tips for Trading the British Pound

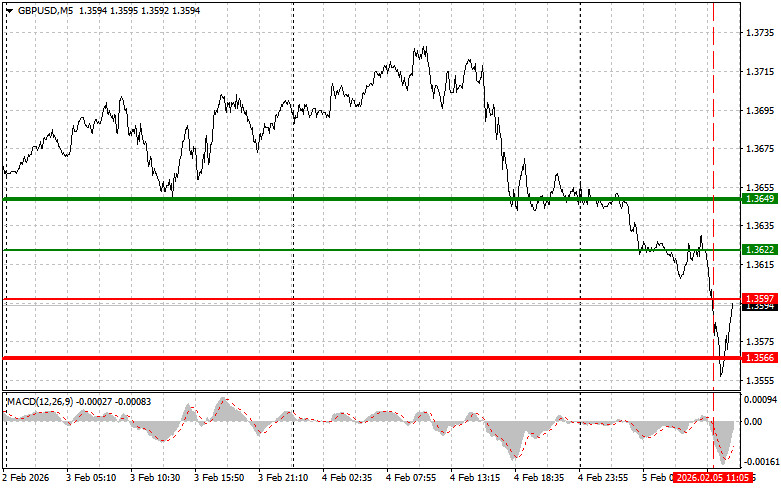

The test of the 1.3597 price level occurred at a moment when the MACD indicator had already moved significantly downward from the zero line, which limited the pair's downward potential. For this reason, I did not sell the pound and missed a good downward move.

Despite positive readings in the UK Construction Purchasing Managers' Index, the British currency came under heavy selling pressure. Investors are likely choosing to lock in profits ahead of the Bank of England's key interest rate meeting, fearing a more dovish stance from the regulator. Growing speculation about a possible easing of monetary policy by the Bank of England in the near future may be putting significant pressure on the pound sterling. If the Bank of England nevertheless adopts a more cautious stance, the pound could see a modest recovery.

In the second half of the day, attention should also be paid to the weekly number of initial jobless claims and a speech by FOMC member Raphael Bostic. These data usually reflect the current state of the market and do not influence the Federal Reserve's monetary policy decisions. An increase in claims may only indicate a slight slowdown in the economy. However, the speech by FOMC member Raphael Bostic deserves attention. His comments on the economic situation, inflation, and monetary policy outlook may provide investors with valuable insight into the future direction of the Fed. The market will closely monitor any signals of a possible shift in the Fed's approach to inflation or economic growth.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

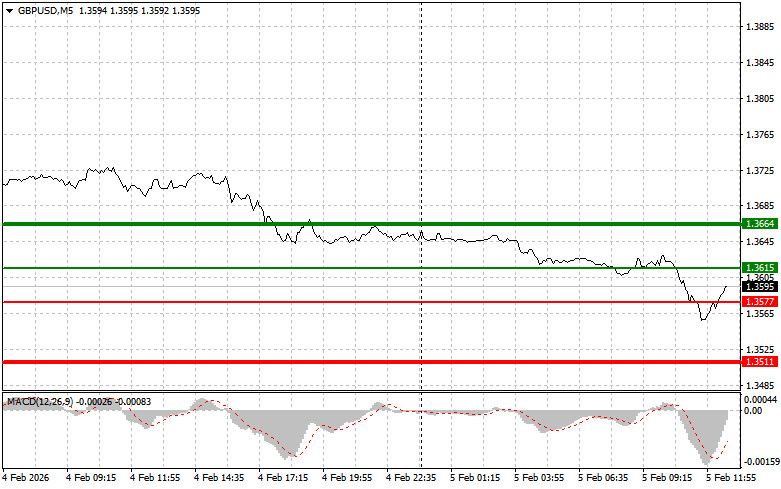

Scenario No. 1: Today, I plan to buy the pound upon reaching the entry point in the level of 1.3615 (green line on the chart), targeting growth toward the 1.3664 level (the thicker green line on the chart). Around 1.3664, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point move in the opposite direction from that level). A rise in the pound today can be expected after weak U.S. data.Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3577 price level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.3615 and 1.3664 can be expected.

Sell Signal

Scenario No. 1: Today, I plan to sell the pound after a break and retest the 1.3577 level (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3511 level, where I will exit short positions and also immediately open long positions in the opposite direction (expecting a 20–25 point move in the opposite direction from that level). Pressure on the pound will return today in the event of strong data.Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3615 price level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3577 and 1.3511 can be expected.

What's on the Chart

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price at which Take Profit can be set or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price at which Take Profit can be set or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making decisions about entering the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.