*) See also: InstaForex trading indicators for XAU/USD

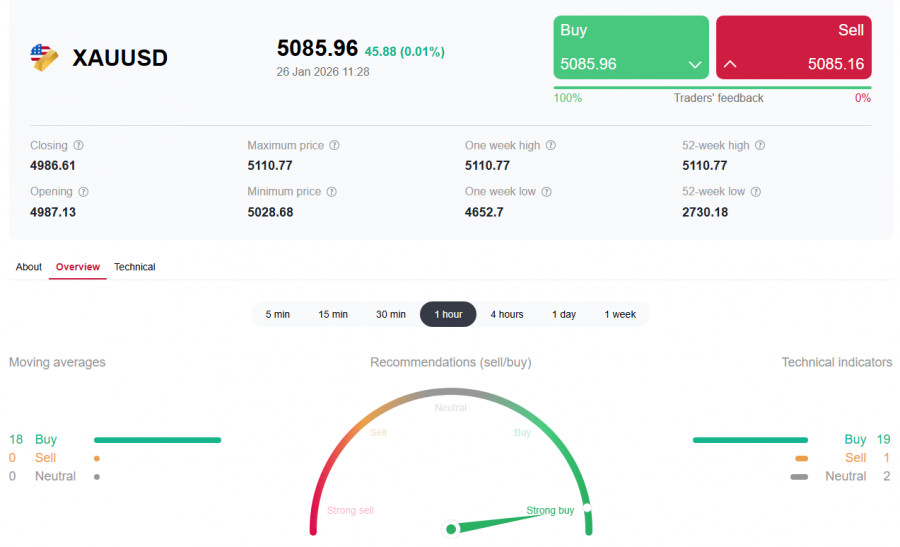

The XAU/USD pair is setting record highs for the 6th trading day in a row, trading confidently near the psychologically important 5100.00 threshold in the first half of the European trading session and demonstrating sustained demand for gold from investors, central banks, and exchange-traded funds.This unprecedented rally is not a random spike but a result of a powerful convergence of fundamental factors that have turned gold into the main safe-haven asset of modern times.

The key driver of growth remains the combination of geopolitical uncertainty, the weakness of the US dollar, and expectations of a dovish Federal Reserve, creating a favorable environment for non-yielding assets.

Three pillars of the gold rally

The continuous rise in prices is supported by three key drivers:

- Strong demand for safe-haven assets. The geopolitical landscape remains extremely unstable. The escalation of the trade conflict between the US and Europe over Greenland, threats of 100% tariffs against Canada, and the lack of progress in negotiations between Russia and Ukraine are causing investors to seek protection from uncertainty en masse. Gold, as a time-tested safe-haven asset, becomes the natural choice.

- Massive "Sell America" strategy. The market has begun a large-scale capital outflow from US-linked assets. This is due not only to trade wars but also to the Trump administration's attack on the Fed's independence, as well as growing concerns about the level of US national debt. The US Dollar Index (USDX) hit a 6-month low around 97.00, directly supporting gold priced in a weakening currency.

- Structural changes in demand and expectations of Fed easing. The actions of major central banks indicate a strategic shift:

- Reserve accumulation. The People's Bank of China has been purchasing gold for the 14th consecutive month, with the central banks of Poland, India, and Brazil also buying gold.

- Record inflow into ETFs. Global investment in gold ETFs rose by 25% in 2025, with their assets under management reaching a staggering $558.9 billion.

- Expectations from the Fed. The market is pricing in two rate cuts from the Fed in 2026. The prospect of cheaper money and falling yields on alternative instruments (e.g., bonds) makes non-yielding gold more attractive.

Outlook and main risks: all eyes on the Fed

The short-term prospects for gold largely depend on two events this week:

1. Fed meeting on January 27 and 28. Although the rate will almost certainly remain unchanged (at 3.75%), the tone of Jerome Powell's comments will be crucial for the market."Dovish" scenario. Hints at imminent or deeper policy easing will lead to further dollar weakness and new growth in gold."Hawkish" scenario. Warnings about inflation risks and signals of a prolonged pause in rate cuts may temporarily strengthen the dollar and provoke a correction in gold.

2. Threat of a US government shutdown. The intensification of intraparty conflict in Congress and the risk of halting funding for government entities may exacerbate the flight from the dollar and fuel the "Sell America" trade, further supporting gold.

Market contradictions: the dollar paradox

Despite the narrative of de-dollarization, it is important to note the paradox also observed by some economists: demand for US Treasury bonds (national debt) remains high; the use of the dollar in international transactions (according to SWIFT data) continues to rise.

This means that the weakening of the dollar is more tactical than catastrophic for it, and a turnaround in market sentiment is possible if the macro picture changes.

Technical picture and scenario analysis

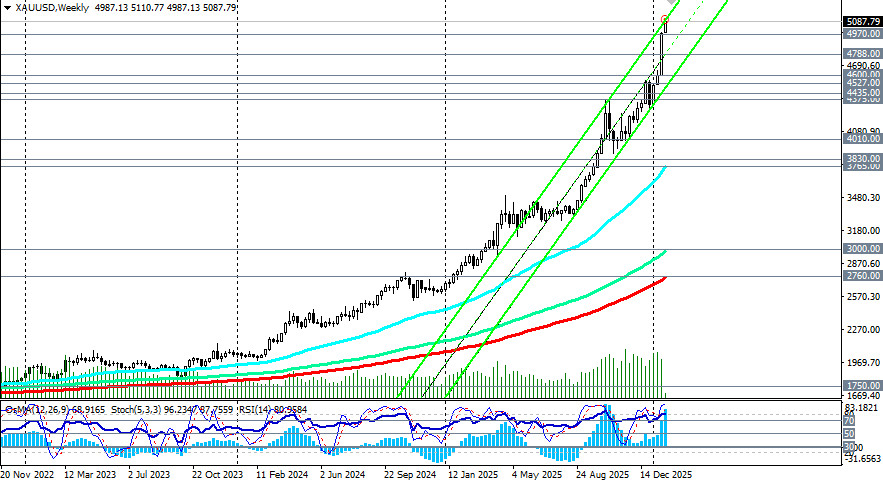

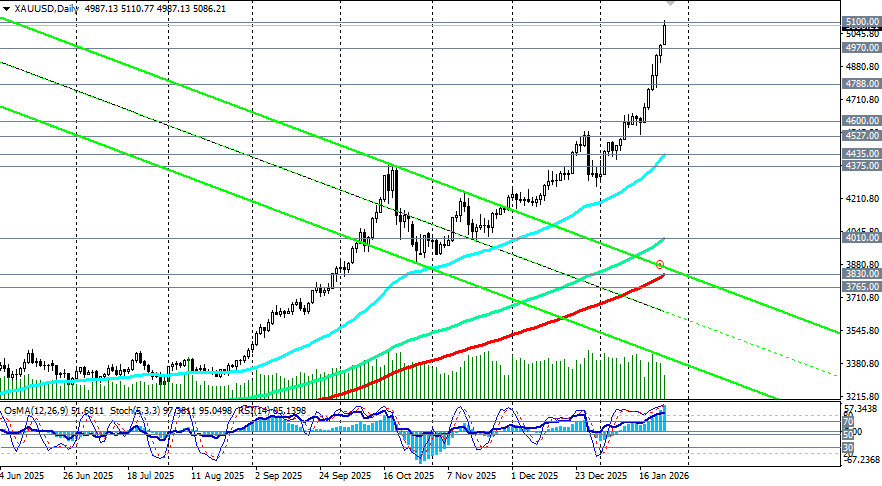

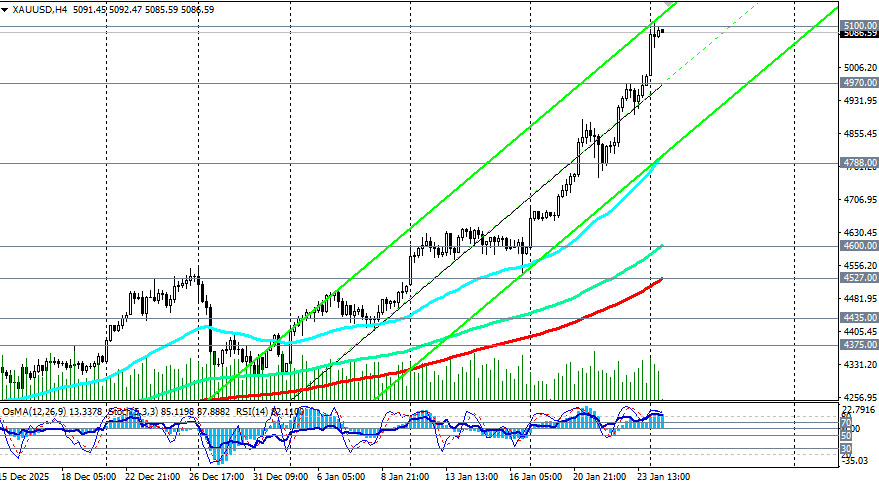

In short, the market is in a state of overboughtness, but the trend is strong.

From a technical perspective, gold shows a pronounced impulsive rise. The psychological level of 5000.00 was already surpassed at the opening of Monday's trading. Now the nearest task for the bulls is to overcome and consolidate above the 5100.00 mark ("round" level and upper boundary of the ascending channel on the weekly chart). If the current dynamics are maintained, the next targets could be 5200.00–5250.00.

However, the 6-day continuous rise also indicates extreme overboughtness. Any negative trigger or profit fixation could provoke a technical correction. The first (short-term) support levels for such a scenario are around 5000.00–4970.00 (EMA50 and the lower line of the ascending channel on the 1-hour chart), while a more serious one lies in the zone of 4800.00 (EMA50 and the lower line of the ascending channel on the 4-hour chart) – 4788.00 (EMA200 on the 1-hour chart).

Main scenario

Given the continued weakness of the US dollar, geopolitical tensions, and expectations of a dovish Fed, gold may continue to rise, aiming to consolidate above 5100.00 and transition into a new phase of the upward trend.

Alternative scenario

A correction is possible in the event of unexpectedly hawkish Fed rhetoric, a sharp improvement in global risk appetite, or a rebound in the US dollar.However, even in this case, the decline is likely to be limited and corrective in nature within the broader bullish trend. Either way, the bullish trend remains dominant, and any pullbacks are seen by the market as buying opportunities.

Conclusion

Gold is at the peak of a powerful uptrend, fueled by the perfect storm of geopolitics, a weak dollar, and structural growth in demand. The likelihood of surpassing the 5100.00 level in the coming days is extremely high.

However, investors should exercise increased caution. The market is overheated, and key events this week — the Fed's decision and the situation with US national debt — could trigger profit-taking and a technical correction. The long-term bullish trend is currently uncontested, but short-term volatility may increase sharply. A sensible strategy may be to watch how prices react to Fed news rather than chasing the market at current extreme highs.